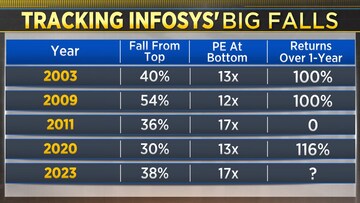

Infosys is clearly the bellwether stock. This is not the first time Infosys stock has fallen 40 percent, in fact from January 2003 to April 2003 this is a stock which fell 40 percent. There have been five cases when the stock has fallen this much in the last 20 years. The stock fell 40 percent from the peak to the bottom. And the reason at that time, of course, was the poor guidance.

The first time Infosys came out with poor guidance was in 2003. And shocker of a number — there was a bloodbath in the midcap IT space. But look at what happened immediately after that. Returns over the next year were 100 percent.

Next, from February 2007 to January 2009, is the period in which the entire market fell. This was a time of global financial crisis. The equity markets globally going through a bear market. Infosys stock from 2007 to 2009 fell 54 percent from peak to bottom. It was in line with the global financial crisis and Nifty itself fell 58 percent.

Again, returns over the next year — 100 percent when it started to move up.

The third instance was from December 2010 to September 2011. This was pretty unique because the stock fell 36 percent from peak to bottom. There was a general slowdown in IT. But there were also the beginning of leadership issues in IT because both Narayan Murthy and Nandan Nilekani had moved on. After that others came in and there were some issues during that period. The returns over the next year were actually zero. So it fell 36 percent over a one to one and a half year period, and then returned nothing over the next one year, which was quite interesting.

Then the fourth instance was from September 2019 to March 2020. The stock fell 30 percent from peak to bottom. There were two concerns, there was a whistleblower issue, which led to a big fall. And of course, there was COVID, but returns over the next year were 116 percent.

And this actually was the start of the Great Indian Bull market in the IT space.

Now in the last one to one and a half year — from January 2022 to now, the stock has fallen about 38 percent from peak to bottom. Again, the issues are the US slowdown and the valuation compression because, before the start of this fall, Infosys had gone to 31 times one year price to forward. Everyone said 30 times is the new normal. Dividends over the next year — no one knows the answer to that.

One should look at where the stock bottoms out and how much it rallies after that. In 2003, when it fell 40 percent, the stock bottomed out at 13 times one year forward, it gave 100 percent returns. In 2009, it bottomed out at 12 times, it gave 100 percent returns. In 2011, when it bottomed out 17 times, it stayed flat for zero for a year. So it had a time correction. In 2020, again, when it bottomed out at 13 times, it again gave one year return of about 116 percent.

This year, what's happened is it has fallen 38 percent but right now its P/E is at 17 times. And nobody knows if it has bottomed out yet, so that's where the question mark is in terms of returns over the next year.

There are two scenarios. Scenario one is the stock bottoms out at a historical P/E of 13 times. In that case, it bottoms out at somewhere around Rs 1,000. In that case, there is a good chance of it doubling. Another scenario is it has a time correction, it bottoms out here 17 times and maybe has some time consolidation and some time correction.

For more details, watch the accompanying video