Dr Reddy's Laboratories and other pharma companies are battling an antitrust lawsuit in the US over the $8 billion blockbuster cancer drug Revlimid generic.

Pharma retail giants like Walgreens and CVS are seeking compensation alleging that companies such as Dr Reddy's, Celgene, Natco, and Teva implemented measures to limit competition in the generic version of Revlimid until 2026.

The concerns are due to the significant profits generated from Revlimid generic, surpassing initial expectations.

The Street has, however, remained unfazed by the uncertainty around the litigation, likely taking comfort in the fact that it may take several years for a settlement to be reached, and the strong cash reserves of the companies.

Dr. Reddy's has cash of around ₹5,900 crore, Cipla has over ₹7,500 crore, Natco at around ₹1,800 crore, and Zydus at over ₹1,500 crore.

In a conversation with CNBC-TV18, Vishal Manchanda, Pharma Analyst at Systematix Group, and Aditya Khemka, fund manager at InCred Healthcare PMS, discussed the implications of the litigation on Dr Reddy's and the outlook for the pharma sector.

Manchanda of Systematix says it is best to wait and watch how the litigation unfolds. However, he believes other companies marketing the product directly in the US might face the full legal consequences if any issues arise.

“Reddy’s (DRL) potentially has made the most out of the Revlimid opportunity. They would make almost the same money as they have made in last two years in the next two years,” Manchanda said.

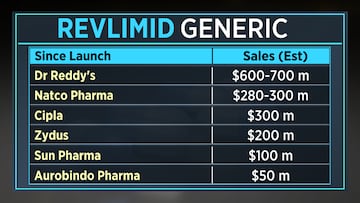

Dr Reddy’s, which launched the cancer drug exclusively in September 2022 is estimated to have clocked sales worth $600-700 million, totaling nearly 40-50% of overall profit. The company says the accusations are unfounded and it will challenge the legal action.

Natco, Manchanda noted, may be a hedged as it is not the front end player in the Revlimid market. Their partner, Teva, would potentially have to bear the liability in case of an adverse outcome of the litigation.

A settlement generally entails a percentage of profits made from the drug or even the entire amount of profits along with penalties.

Revlimid, a cancer medication developed by Celgene, now under Bristol Myers Squibb (BMS), is prescribed for various blood cancer patients.

BMS, the American pharmaceutical firm, reached agreements with several generic companies to distribute restricted quantities of generic Revlimid in the US beginning March 2022.

Generic versions of Revlimid were permitted to be sold in limited volumes starting March 2022 until January 2026.

Natco, in collaboration with Teva, led the launch, followed by Dr. Reddy's, Cipla, Zydus, and others.

Also Read

InCred's Khemka says while litigation is a worry, it is the valuation multiples of the companies that is more concerning. They appear stretched and it may be time to look at them on the basis of their base business excluding profits being made from Revlimid, he noted.

"As I was saying, the profits from Revlimid can account for, in some cases. as much as 50% of the net profit that the company is reporting, and in some cases 10 to 20%. So, the stock prices or these market caps need to be looked at in context of their business profitability, and not the profitability including Revlimid," he noted.

While Khemka believes the base business for most of the companies will continue to grow even beyond January 2026, "Once the Revlimid profits get knocked off by competition and free market dynamics in January 2026, on a consolidated reporting number basis for FY27 (versus FY26) will clearly be a year of decline in profits and cash flows."

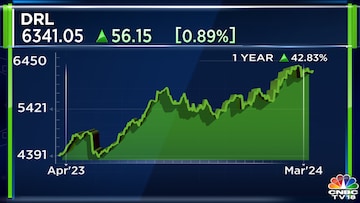

The market capitalisation of Dr Reddy’s is around ₹1,05,713.72 crore. Its shares have gained close to 43% in the past year.

For the entire discussion, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Mar 19, 2024 10:27 AM IST