There are many large-caps that don’t get the attention of the stock market admirers, and one of them is Honeywell Automation. The company is virtually debt-free with consistent profit growth of 33.04 percent over five years.

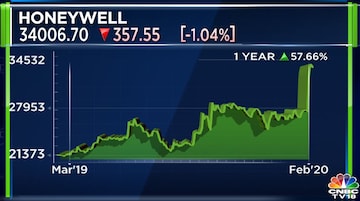

In the last 10 years, the stock has delivered returns of over 1,000 percent, and about 270 percent in the last five years. This year itself, the stock has climbed 30 percent.

The company is primarily into automation and control systems but also diversified into businesses like realty, chemicals, retail amongst others. In the third quarter of the current fiscal, the company’s net profit surged 69 percent year-on-year (YoY) to Rs 144.74 crore. On a YoY basis, net sales jumped 11 percent while profit before tax soared 47.3 percent.

In terms of valuation, it is highly-priced but with a return-on-equity (RoE) of 23 percent. Furthermore, the company is debt-free and keeps sufficient cash-on-books to mark itself as a ‘quality stock’.

In the list of top-10 fastest wealth creators during 2014-19, Motilal Oswal added the stock to its list saying, “The market capitalization rose to Rs 19,700 crore in 2014 from Rs 2,700 crore in 2014. The P/E was 55x in FY19 compared to 31x in 2014.”

According to an earlier report by Antique Research, the stock expected a 20 percent CAGR in software sales, significantly ahead of overall company sales. With limited big-ticket capex from the private sector, spending has been directed to improving efficiency through automation.

The brokerage remains positive on the stock from a long-term perspective, given that the company is at the forefront of innovation with a focus on automation and industrial IoT.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Andhra Pradesh's silk hub, weavers' cry for help echoes through election season

May 3, 2024 12:24 PM

Feroze Gandhi to Rahul Gandhi: Rae Bareli's tryst with Congress

May 3, 2024 11:36 AM

Rahul Gandhi to contest from Raebareli, close aide KL Sharma from Amethi

May 3, 2024 8:39 AM

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM