Quarterly results will be in in focus on Dalal Street this week as the earnings season picks up the pace. Besides, the first IPO of 2022 will be tracked closely, after a blockbuster 2021 that saw a majority of the 63 public issues enjoy robust investor interest. Updates on the new variants of COVID-19 will also be on investors' radar.

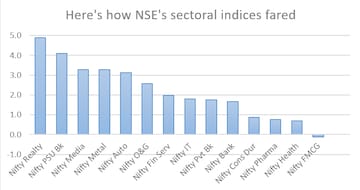

Last week, headline indices Sensex and Nifty50 clocked their fourth weekly gains in a row, led by gains across sectors, especially in metal and PSU banking stocks. The Nifty Bank gained 1.7 percent, following its best week since May 2021.

A total of 40 Nifty50 stocks finished the week in the green.

| Gainers | Losers | ||

| Stock | Weekly change (%) | Stock | Weekly change (%) |

| L&T | 7.3 | Wipro | -10.1 |

| Infosys | 6.3 | Asian Paints | -5.9 |

| M&M | 6.3 | Nestle | -2.5 |

| Adani Ports | 6 | HUL | -2.2 |

| Coal India | 5 | Axis Bank | -1.2 |

| Tata Steel | 4.6 | Britannia | -0.7 |

| UPL | 4.5 | Dr Reddy's | -0.4 |

| HDFC | 4.5 | HDFC Bank | -0.4 |

| Reliance Industries | 4.2 | IndusInd Bank | -0.2 |

| Indian Oil | 4.1 | Eicher Motors | -0.2 |

All eyes on India Inc earnings

With factory output and inflation data now behind, the focus will now shift entirely to corporate earnings. The market will begin the week by reacting to the quarterly performances of HCL Technologies and HDFC Bank, and brace for a slew of blue-chip results including Reliance Industries, Hindustan Unilever, Bajaj Finance, SBI Life and ICICI Bank.

Expectations around the Union Budget will also be in the spotlight during the week.

"The market has made remarkable progress in the last one month and inching closer to a record high. We have mixed indications from the global markets; we believe earnings would dictate the market trend ahead," said Ajit Mishra, VP Research at Religare Broking.

"On the index front, a move above 18,350 would pave the way for a new record high while 17,950-17,700 levels would act as support in case of profit taking. We recommend maintaining focus on sectors/themes that are playing out well and using intermediate correction to create long positions," he said.

Mishra believes metal, IT, realty and pharma spaces may outshine the market during the week, though participation may remain broad-based.

Technical outlook

The Nifty50 has taken out the resistance level of 17,950 decisively, and appears to be targeting its all-time high (18,604), according to Yesha Shah, Head of Equity Research, Samco Securities. She advises traders to maintain a bullish bias on the market.

"Minor dips cannot be ruled out going ahead and dips around immediate support levels can be used as buying opportunities. Immediate support for the Nifty is now placed around 17,700," Shah added.

Here are the key factors and events that are likely to influence Dalal Street in the week starting January 17:

DOMESTIC CUES

Earnings

Jan 17: UltraTech and Tatva Chintan

Jan 18: Bajaj Finance, ICICI Prudential Life Insurance, Just Dial, L&T Technologies and Tata Elxsi

Jan 19: Bajaj Auto, JSW Energy, L&T Infotech, Rallis, Tata Communications and ICICI Lombard General Insurance

Jan 20: Asian Paints, HUL, Bajaj Finserv, Bajaj Holdings, Biocon, Concor,

Cyient, Havells, Mphasis, Bank of Maharashtra, Persistent Systems and VST Industries

Jan 21: Reliance Industries, HDFC Life, SBI Life, CSB Bank, JSW Steel, L&T Finance Holdings, Tanla, Polycab and PVR

Jan 22: ICICI Bank and Yes Bank

IPO

The IPO of AGS Transact Technologies, an omni-channel payment solution company, will hit the Street on January 19. The public offer is entirely an offer for sale (OFS) of equity worth Rs 680 crore.

FII flow

Foreign fund flows will remain in focus. Last week, foreign institutional investors net sold Indian equities worth Rs 1,345.5 crore ($182.2 million), according to provisional exchange data.

In the previous week, they had made net purchases of Rs 3,202.1 crore ($430.5 million).

Corporate action

| Company | Ex date | Purpose | Record date |

| Eldeco Housing & Industries | 17 Jan | Stock split from Rs 10 to Rs 2 | 18 Jan |

| Hinduja Global Solutions | 17 Jan | Interim dividend Rs 150 | 18 Jan |

| Info Edge | 17 Jan | Interim dividend Rs 8 | 18 Jan |

| Joonktollee Tea & Industries | 18 Jan | Rights issue | 19 Jan |

| Anand Rathi Wealth | 19 Jan | Interim dividend Rs 5 | 20 Jan |

| Choice International | 19 Jan | Rights issue | 20 Jan |

| TCS | 19 Jan | Interim dividend Rs 7 | 20 Jan |

| HCL Tech | 20 Jan | Interim dividend Rs 10 | 22 Jan |

| Maharashtra Corporation | 20 Jan | EGM | - |

| RailTel | 20 Jan | Interim dividend Rs 1.75 | 21 Jan |

| Siemens | 20 Jan | Final dividend Rs 8 | - |

| Veer Global Infraconstruction | 20 Jan | Rights issue | 21 Jan |

| Visagar Financial Services | 20 Jan | Bonus issue | 21 Jan |

| Visagar Financial Services | 20 Jan | Stock split from Rs 2 to Re 1 | 21 Jan |

| Wipro | 21 Jan | Interim dividend - Re 1 | 24 Jan |

GLOBAL CUES

United States

Jan 19: US housing data

Jan 20: US jobs data, home sales data, crude stockpiles data

Europe

Jan 18: UK unemployment data

Jan 19: UK inflation data

Asia

Jan 17: China GDP, industrial production, retail sales data

Jan 18: Japan rate decision

Jan 21: Japan inflation, BoJ minutes, Hong Hong business confidence data

Note To Readers

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM