Auto sales numbers, manufacturing and services PMI readings, and global markets will be in focus on Dalal Street this week. Updates on the COVID situation amid concerns about the Omicron variant, which kept investors cautious last week, will remain on investors' radar.

Foreign fund flow will also be tracked closely as FIIs continue to offload Indian shares.

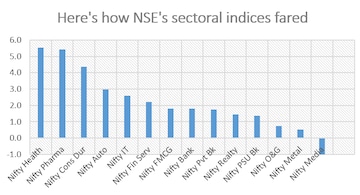

Last week, the Sensex and Nifty50 clocked a third straight weekly gain, rising around two percent each. Strength in pharma, consumer, automobile and IT stocks pushed the headline indices higher amid a broad-based upmove in the last week of 2021.

The Nifty rose 24 percent in 2021, and the Sensex 22 percent -- their best annual returns since 2017. (Read more on how market fared in 2021)

What to expect this week

Though the market has been witnessing a recovery, it’s too early to say if it is out of the woods, said Ajit Mishra, VP Research at Religare Broking.

"The recent rise in COVID cases has prompted a few key states to announce restrictions and that may extend if the situation deteriorates further. On the positive side, the banking pack has regained some strength, which may help the Nifty test the 17,500 zone," he said.

Mishra expects banking, pharmaceutical, IT and FMCG stocks to outshine others on Dalal Street this week.

Technical outlook

Traders should maintain a neutral to mildly bullish outlook as long as the Nifty50 does not fall below 17,100, according to Yesha Shah, Head of Equity Research at Samco Securities. A close above next crucial resistance at 17,650 will signal the continuation of a major uptrend, she said.

"However, the Bank Nifty is still trading below crucial resistance at 35,800. A failure to surpass this level can lead to retest of lower levels," said Shah, who sees immediate support for the Nifty at 17,100.

Here are the key factors and events that are likely to influence Dalal Street in the week starting January 3:

DOMESTIC CUES

Macroeconomic data

On Monday, a private PMI survey on manufacturing in the country will be released. Separate data on trade is due on the same day.

PMI data on services will be out on Wednesday.

FII flow

Foreign institutional investors net sold Indian equities worth Rs 38,521 crore ($5.1 billion) in October through December -- the first instance of three straight months of outflows in five year, according to provisional exchange data.

Corporate action

| Security Name | Ex date | Purpose | Record date |

| Quantum Digital Vision India | 4-Jan-22 | EGM | - |

| Johnson Pharmacare | 5-Jan-22 | Stock split from Rs 10 to Re 1 | 6-Jan-22 |

| Mangalam Timber Products | 5-Jan-22 | Amalgamation | 6-Jan-22 |

| Mazagon Dock Shipbuilders | 6-Jan-22 | Interim dividend Rs 7.1 | 7-Jan-22 |

| Indian Metals & Ferro Alloys | 7-Jan-22 | Bonus issue 1:1 | 10-Jan-22 |

GLOBAL CUES

United States

A private PMI survey on manufacturing activity in the world's largest economy is due on Tuesday.

Minutes of the last scheduled meeting of the US central bank will be released on Thursday. Data on unemployment is due on Friday.

Europe

PMI manufacturing survey data on the United Kingdom is due on Tuesday. Germany's inflation data is due on Thursday.

Asia

PMI manufacturing survey data on China is due on Tuesday. Data on consumer confidence in Japan is slated for a release on Wednesday.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Interview | PM Modi targets Naveen Patnaik and BJD — asks Odisha a chance for BJP

Apr 28, 2024 7:53 PM

PM Modi says great men like Nehru and Ambedkar were against reservation based on religion

Apr 28, 2024 6:41 PM

Exclusive | Congress has turned Bengaluru from 'tech hub to tanker hub': PM Modi

Apr 28, 2024 6:18 PM

Modi Interview | Here's what the Prime Minister said on inheritance tax

Apr 28, 2024 6:05 PM