The Union Budget for the coming financial year will take centre stage on Dalal street this week. The Economic Survey for the year ending March 2022, to be released a day prior to the presentation of the Budget in Parliament, will also be in focus to assess the resilience of the economy against the coronavirus pandemic.

Corporate earnings will also be in the spotlight once again.

The week that was

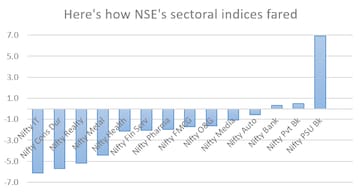

Headline indices Sensex and Nifty50 fell around three percent each last week -- a second straight weekly loss -- dragged by IT stocks, as the outcome of the Federal Reserve's scheduled policy review rattled world markets. Gains in PSU banks lent some support. The Sensex lost 1,837 points and the Nifty shed 515.2 points.

Broad-based weakness pulled both benchmarks lower. The Nifty Midcap 100 fell 2.5 percent and its smallcap counterpart 3.7 percent.

As many as 38 Nifty50 stocks finished the week in the red.

| Losers | Gainers | ||

| Stock | Weekly change (%) | Stock | Weekly change (%) |

| Tech Mahindra | -15.4 | Maruti Suzuki | 6.4 |

| Bajaj Finserv | -11.9 | Bajaj Auto | 5.7 |

| Wipro | -10.3 | Cipla | 5.7 |

| Tata Steel | -10.1 | Axis Bank | 4.9 |

| Titan | -9.7 | NTPC | 3.9 |

| Divi's | -9 | IndusInd | 3 |

| Bajaj Finance | -8.8 | SBI | 2.4 |

| Dr Reddy's | -8.1 | ONGC | 1.2 |

| HCL Tech | -8.1 | HUL | 1 |

| JSW Steel | -8 | Sun pharma | 0.9 |

Around 410 stocks in the BSE 500 index -- the broadest index on the bourse -- succumbed to negative territory.

The week ahead

All eyes will be on the government's Budget for FY23. Auto sales, readings of manufacturing as well as services PMI surveys, corporate earnings and COVID updates will also be on investors' radar.

"We expect the government to continue with the growth agenda but with a roadmap for fiscal prudence... We believe the Union Budget would set the tone for the domestic market amid the global sell-off. Volatility remains high during the Budget week so participants should continue with a cautious stance and prefer hedged positions," said Ajit Mishra, VP-Research at Religare Broking.

A slew of companies are slated to report their quarterly financial results during the week, including Tata Motors, Sun Pharma, Indian Oil, BPCL, HDFC, ITC, Titan and SBI.

Technical outlook

The Nifty50 is trading around its 100-day exponential moving average on the daily chart, and appears to have found a cushion at the previously established demand zone of 16,850, according to Yesha Shah, Head of Equity Research, Samco Securities. "The Nifty Bank index is bouncing from the short-term average on the daily chart. These pieces of evidence are hinting at the continuation of a major uptrend," she said.

Shah suggests traders to maintain a bullish bias as long as the 50-scrip index holds 16,850, a break below which can trigger a fall up to 16,000. She sees immediate resistance for the index at 17,650.

She expects resistance for the index at 18,300, and advises traders to maintain a cautious to mildly bullish outlook.

Religare Broking's Mishra expects the Nifty to hover in a 16,600-17,600 range. "A decisive break on the either side will trigger the next directional move," he said.

Here are the key factors and events that are likely to influence Dalal Street in the week starting January 31:

DOMESTIC CUES

Jan 31: Economic Survey for FY22, infrastructure output data

Feb 1: Union Budget, manufacturing PMI survey

Feb 2: Trade data

Feb 3: Services PMI survey

Earnings

| Date | Quarterly earnings |

| Jan 31 | Tata Motors, Indian Oil, Bharat Petroleum, Sun Pharma, Suven, DLF, Infibeam, KPIT Tech, UCO Bank, UPL, Exide, Krsnaa |

| Feb 1 | Tech Mahindra, Adani Ports, Indian Hotels, JSPL |

| Feb 2 | HDFC, Tata Consumer, Zee, Apollo Tyres, Adani Total, Adani Green, Dabur, Jubilant FoodWorks, Indian Overseas Bank, JK Lakshmi Cement, Zydus Wellness, M&M Financial, Reliance Capital, Windlas Biotech |

| Feb 3 | ITC, Titan, GAIL, Adani Power, Adani Transmission, AB Capital, Cadila, Lupin, JK Tyre, Rolex Rings |

| Feb 4 | Divi's, InterGlobe Aviation, Aditya Birla Fashion, Devyani International, Paytm |

| Feb 5 | SBI, Bank of Baroda, GoColors |

IPO

AGS Transact Technologies shares will be listed on stock exchanges BSE and NSE on January 31. Adani Wilmar's IPO will close for subscription on the same day.

Vedant Fashions' IPO to raise up to Rs 3,149 crore will hit the Street on February 4.

FII flow

Foreign fund flows will remain in focus. Last week, foreign institutional investors net sold Indian equities worth Rs 19,451.6 crore ($2.6 billion), according to provisional exchange data.

Corporate action

| Stock | Ex date | Purpose | Record date |

| CCL Products India | Jan 31 | Interim dividend Rs 3 | Feb 1 |

| Masket | Jan 31 | Interim dividend Rs 7 | Feb 1 |

| Saregama India | Jan 31 | Interim dividend Rs 30 | Feb 1 |

| Visaka Industries | Jan 31 | Interim dividend Rs 7 | Feb 1 |

| India Grid Trust | Feb 1 | Income distribution (InvIT) | Feb 2 |

| Orient Electric | Feb 1 | Interim dividend Re 0.75 | Feb 2 |

| PCBL | Feb 1 | Interim dividend Rs 10 | Feb 2 |

| Concor | Feb 2 | Interim dividend Rs 2 | Feb 3 |

| Cosmo Films | Feb 2 | Interim dividend Rs 10 | Feb 3 |

| Hazoor Multi Projects | Feb 2 | EGM | - |

| Nakoda Group of Industries | Feb 2 | EGM | - |

| Powergrid Infra Investment Trust | Feb 2 | Income distribution (InvIT) | Feb 3 |

| Sharda Cropchem | Feb 2 | Interim dividend Rs 3 | Feb 3 |

| Share India Securities | Feb 2 | Interim dividend Rs 2 | Feb 3 |

| Torrent Pharma | Feb 2 | Interim dividend Rs 25 | Feb 3 |

| Wendt India | Feb 2 | Interim dividend Rs 20 | Feb 3 |

| Accelya Solutions India | Feb 3 | Interim dividend Rs 17 | Feb 4 |

| Bigbloc Construction | Feb 3 | Interim dividend Re 0.1 | Feb 4 |

| Dhruv Wellness | Feb 3 | EGM | - |

| Greenpanel Industries | Feb 3 | Interim dividend Rs 1.5 | Feb 4 |

| GRM Overseas | Feb 3 | Interim dividend Re 1 | Feb 4 |

| IEX | Feb 3 | Interim dividend Re 1 | Feb 4 |

| IIFL Finance | Feb 3 | Interim dividend Rs 3.5 | Feb 4 |

| IIFL Securities | Feb 3 | Interim dividend Rs 3 | Feb 4 |

| Integra Garments & Textiles | Feb 3 | Stock split from Rs 3 to Re 1 | Feb 4 |

| Intellivate Capital Advisors | Feb 3 | EGM | - |

| Kirloskar Ferrous Industries | Feb 3 | Interim dividend Rs 2.5 | Feb 4 |

| LA Opala RG | Feb 3 | Interim dividend Re 1.5 | Feb 4 |

| Motilal Oswal Financial Services | Feb 3 | Interim dividend Rs 7 | Feb 4 |

| NTPC | Feb 3 | Interim dividend | Feb 5 |

| Parshva Enterprises | Feb 3 | Bonus issue 205:100 | Feb 4 |

| Sanrhea Tech Textiles | Feb 3 | EGM | - |

| Sindhu Trade Links | Feb 3 | Stock split from Rs 10 to Re 1 | Feb 4 |

| SRF | Feb 3 | Interim dividend Rs 4.75 | Feb 4 |

| Sword-Edge Commercials | Feb 3 | Bonus issue 1:1 | Feb 4 |

| Symphony | Feb 3 | Interim dividend Rs 1 | Feb 4 |

| Transport Corp of India | Feb 3 | Interim dividend Rs 2 | Feb 4 |

| TCI Express | Feb 3 | Interim dividend Rs 3 | Feb 5 |

| Thangamayil Jewellery | Feb 3 | Interim dividend Rs 5 | Feb 4 |

| Upsurge Investment & Finance | Feb 3 | Interim dividend Re 0.5 | Feb 4 |

| Vaibhav Global | Feb 3 | Interim dividend Rs 1.5 | Feb 5 |

| Zensar | Feb 3 | Interim dividend Rs 1.5 | Feb 4 |

| Chambal Fertilisers & Chemicals | Feb 4 | Interim dividend Rs 4.5 | Feb 7 |

| Embassy Office Parks REIT | Feb 4 | Income distribution RITES | Feb 7 |

| Marico | Feb 4 | Interim dividend Rs 6.25 | Feb 7 |

| Siyaram Silk Mills | Feb 4 | Interim dividend | Feb 7 |

GLOBAL CUES

| Date | US | Europe | Asia |

| Jan 31 | Germany inflation data | Japan factory output data, retail sales data, consumer confidence reading | |

| Feb 1 | Manufacturing PMI | UK housing data, consumer credit data, France inflation data | Japan unemployment rate |

| Feb 2 | Crude stockpile | ||

| Feb 3 | Jobs data | UK rate decision | Japan services PMI |

| Feb 4 | Employment rate |

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM