Twin factors keep CSB Bank in focus. First is the street consensus of buying good banking stocks on dips, and the second is its exposure to gold, where investors are flocking to after global equity markets went into a tizzy.

Another factor that differentiates the bank from its peers is its relatively higher Net Interest Margin (NIMs). However, in line with the weakness in the market, the stock has corrected over 10 percent from its peak.

Explaining the Gold exposure and better NIMs

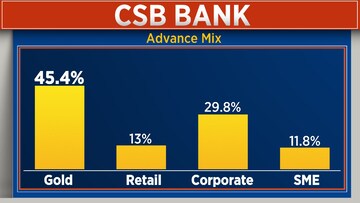

Gold loans comprise of nearly half of the advances. The segment grew by 51 percent in the December quarter, a clear trend that the bank is eating into the market share of incumbent and legacy gold financiers like Manappuram and Muthoot Finance.

These gold loans have better yields in comparison to other loans. Additionally, credit cost on such loans is nearly zero. Since CSB has a significant exposure to the same, this will reflect in better NIMs, compared to its peers.

Geographical break up and Vision 2030

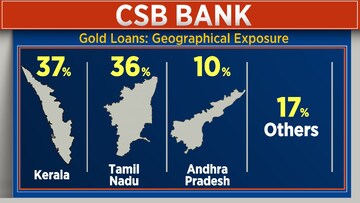

Bulk of their gold loans have exposure to South Indian states namely Kerala, Tamil Nadu and Andhra Pradesh.

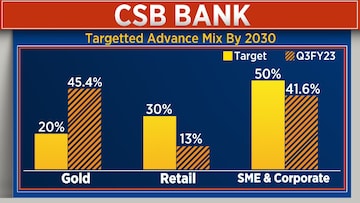

Additionally, the management has said that they intend to grow their SME and corporate loan book from here on and have given their vision that by 2030, Gold as a percent of their advances will come down to 20 percent from 45 percent currently.

Cost of deposits has moved up and is likely to keep moving higher in the coming quarter, inline with the entire banking system. The NIMs as well have spiked but the management has said they would be content with NIMs around 5 percent and are also targeting overall loan growth of around 25 percent.

The bank has been bracing for growth as they have increased the total number of branches by nearly 15 percent in past year which is faster than the industry average.

On a price-to-book value basis, the stock trades at around 1.2x which is a little higher than peers, but not very expensive. The Promoter of the bank is the Fairfax Group owned by Prem Watsa while its shareholding also boosts of some marque institutional names both foreign and domestic.

(Edited by : Hormaz Fatakia)