Coronavirus has taken the entire world by storm and till now over 130 in China have succumbed to this disease. The rapid spread of coronavirus has also shaken the stock markets around the world. In fact, market participants have been making cautious bets in the equities after the virus began to spread to different countries, claiming lives.

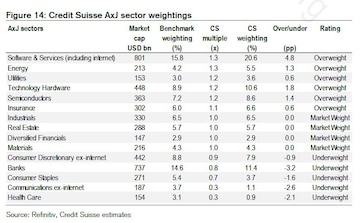

Credit Suisse in its recent research report cited vulnerable sectors that might be affected by the disease. “Among sectors, the virus reinforces our confidence in existing ‘overweights’ in IT and internet and ‘underweights’ in consumer ex-internet and banks. The virus should not greatly affect global IT demand and could help internet names with e-commerce businesses,” it stated.

“Among sectors, we feel comfortable with our positions in the biggest sectors. Our key ‘overweights’ among large sectors are IT and Internet. Global IT demand and production should be largely unaffected by the virus, and fear of shopping malls could enhance e-commerce purchases,” the report further added.

The global brokerage has also expressed its view on the equities. It believes moderate optimism to linger about 6-12 months on an expected recovery in the regional economy, but the coronavirus worsens the risk-reward trade-off. China, Hong Kong, Singapore, and Thailand remain to be the most vulnerable countries, said Credit Suisse.

The brokerage largely believes that the Asian economies will normalise quickly after the Wuhan virus recedes. The main impact is on the sentiment rather than the disease itself, consumption and travel patterns can recover as soon as people feel safe to fly and shop.

Disclaimer: CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM