Good traders worry all the time about blowing up. So they cap their exposure to any single position. Most active investors have the opposite problem. They tend to be under-allocated to their best investments.

How much to allocate to active positions deserves some attention. This post looks at a few common-sense rules about position sizing for investors.

Are your multi-baggers making you rich?

Peter Lynch is well known for being the best-performing mutual fund manager in the history of money management. From 1977 to 1990, as manager of the Magellan Fund at Fidelity, he clocked an incredible 29 percent in annual returns. He might be just as well-known for coining the term “multi-bagger”, which appeared for the first time in print, in his book “One up on Wall Street’, published in 1988.

The word has its roots in that most American pastimes, baseball, where bags represent “bases” crossed by the runner during a play. But investors world-over have embraced it, as the ultimate investing prize.

Seeing a three-digit return next to a holding feels wonderful. Like sipping a fantastic, leisurely, luxurious cup of coffee.

If multi-baggers are the ultimate achievement badge for an investor, then having a few of them in your portfolio should mean you’re close to checking off your financial goals. But it rarely seems to work like that.

Position-Sizing: A missing link

Good traders worry all the time about blowing up. There is a ton of literature on position-sizing for traders, the intended outcome being to cap exposure to any position.

The distinction between “traders” and “active investors” is hazy at best, but in this context, let’s think of an active investor as someone who, at the time of buying, expects to hold a stock for a year or more.

Most active investors have the opposite problem to traders. Since most of them do not have clear rules when buying a stock, a common problem is in not having a meaningful allocation to their “multi-baggers”, read as “best-performing holdings”.

Two ways investors end up under-allocated to their winners:

We anchor to absolute rupee amounts when buying a stock, and focus on percentage when tracking stock-level movement when it needs to be the other way around.

Consider this, the next time a stock that is up or down 9 percent is top of mind while it makes up a grand total of 0.2 percent of your portfolio.

So, how much of a stock should you buy?

What it takes to make winners count

A 300 percent return on a 0.5 percent position grows your portfolio by 1.5 percent.

If the market moves by a pedestrian 10 percent at the same time, absolute gain on the “market” part of the portfolio is still 6.6 times the gain on your 3-bagger.

With a 0.5 percent allocation to a 3-bagger in your portfolio, you’d still be only 1.45 percent better off than a 100 percent “fill-it-shut-it-forget-it” passive investor.

Seems to be very little to show for identifying a brilliant stock.

How much to allocate to active positions, deserves some attention.

Let us say you have done the research to find a stock that you think could double in the next three years. You can not be sure but you are optimistic.

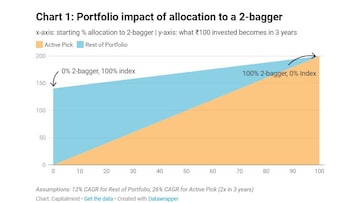

Chart 1 is a simple representation of the impact of starting allocation to this stock while the rest of the portfolio tracks the market near its long-term 12 percent average.

Reading this chart: Assume you start with Rs 100. You identified a stock that could double in 3 years and you were right. x-axis shows how much of Rs 100 you allocated to this active pick, assuming the remainder goes into a low-cost index fund. y-axis is portfolio value after 3 years. The colours show how much of your final portfolio value is made of the active pick versus the rest of your portfolio, in this case, the index.

So, a zero percent active pick, 100 percent index allocation gets you to Rs 140.5 (12 percent CAGR over 3 years), while a 100 percent active pick allocation gets you to Rs 200 (double, since we are assuming a 2-bagger).

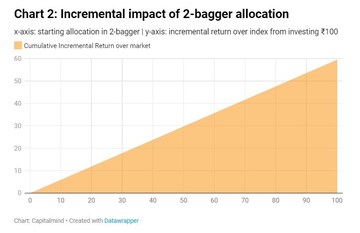

Chart 2 is just an easier way to see the incremental impact of allocating to the 2-bagger, compared to the index. Remember you started with Rs 100.

At zero percent allocation to the active pick, you obviously see no incremental return, while if you went all-in on that stock (which would be madness), you get Rs 60 additionally for every Rs 100 invested. Notice, how at 100 percent allocation, your total return is 100 percent but you take out the 40 percent you would have got from the index anyway and end with 60 percent incremental return.

Come back to why you go through the effort of making active investment decisions over investing in an index fund.

The index is not standing still. So any “active” stock selection effort needs to outperform with respect to the index. And to outperform, overall i.e. the cumulative impact of active stock picks needs to beat the index. If you consider the opportunity cost of time and effort involved, active investment decisions need to beat the index by a decent margin to be worth it.

When taking active positions, you don’t want to have so little allocated that you don’t get rewarded for being right. You also don’t want to have so much allocated that you lose sleep wondering if you’re wrong.

Literature says holding between 12 and 20 stocks offers reasonable protection against unsystematic risk i.e. risk inherent in a specific stock. We arrived at a similar range in our analysis of the optimal number of stocks for the momentum portfolio. One reason adding more stocks beyond a point does not help, is because historically stocks are more correlated when going down than when going up.

So, your upper allocation limit or “lose sleep” limit, to any position could be somewhere between 1/20 = 5 percent all the way up to 1/12 = 8 percent.

Take a moment to think, How much do you end up allocating to fresh positions, whether in a lump sum or overtime?

Simple steps to fix position-sizing

There are a few simple things to do to incorporate position sizes in your investment thinking:

It’s a simple grid of Current Allocation versus Conviction, the idea being to ensure a certain minimum allocation to High conviction stocks and to exit or at least reduce exposure to the low conviction ones.

Takes pressure off finding great investments

There’s an added benefit to paying attention to your position sizing. It makes you more selective about what you hold without making you feel you need to come up with all the answers.

You don’t need to have a ready set of 15-20 stocks at any given time irrespective of market conditions.

For instance, given prevailing market conditions, if you only find seven stocks you like, you allocate a clear percentage of your portfolio to those seven. The rest can go to work in a passive portfolio, to be drawn down as and when you find other stocks to add.

Like new habits, this exercise can feel unnatural at first. After all, aren’t we meant to be poring through balance sheets to unearth the next Bajaj Finance and not dealing with mundane things like position size? But give it a few repetitions, and this framework automatically kicks in for every new purchase and sale.

Being able to look at all daily price movements in the context of your overall portfolio can be wonderfully liberating.

“Learn the rules like a pro, so you can break them like an artist” – Pablo Picasso

— The author, Anoop Vijaykumar, is a fund manager at Capitalmind. The views expressed in this article are his own.

(Edited by : Dipti Sharma)

First Published: Oct 1, 2021 8:39 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM