After a decade of listing, underperformance, and testing the patience of investors, Coal India is back near its IPO price of Rs 245, for the first time in three years.

Coal India has been a consistent underperformer since the stock peaked in July 2015. Since then, the stock has ended the year lower than where it started the year.

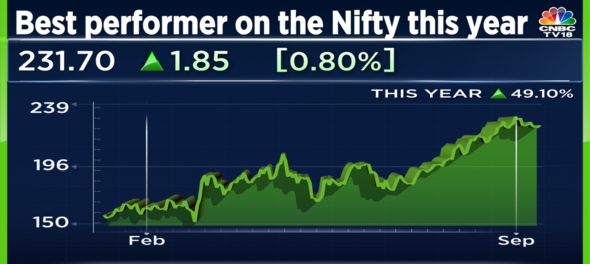

In 2022 so far, the stock has gained nearly 60 percent this year, and is the top performer on the Nifty 50 index. This is the stock's best annual return so far since listing.

Coal India managed to increase production at a time when the country was on the brink of a nationwide power crisis. Demand for coal during the summer months increased 9 percent year-on-year. The increased dependence on coal put the spotlight on ESG funds that have underperformed.

The Nifty 100 ESG Index has dropped 4.3 percent this year while the ESG ETF in India has witnessed outflows of $6.6 million in the first half of 2022 as compared to inflows of $10.2 million during the same period last year.

The Need For Coal

Coal contributes to 55 percent of India's primary commercial energy needs. Coal-based electricity generation accounted for 69.9 percent of the total output in FY22.

The Trend Continues In FY23

Coal India's production has increased 44.6 million tonnes within the first five months of the current financial year. This is higher than the previous best of 44.5 million tonnes, which was the increase during the entire financial year of 2015-16.

A reason behind the increase in production is that the company cleared five mining projects with a capacity of 12.6 million tonnes per annum during FY22. It has also approved 16 other mining products having capacity of nearly 100 million tonnes. "These projects will start contributing in the ensuing years," the company said in its annual report.

Coal India usually produces a higher volume of coal during the second half of the financial year due to better weather conditions. Production split is 44 percent in the first and 56 percent in the second half of the financial year.

In an exchange filing earlier this month, the company mentioned that it is confident of reaching the production target of 306 MT for the first half of the current financial year, barring any seasonal deluge in September, which can impact mining. For the first five months of the year, the production figure stands at 253.3 MT.

What Do The Experts Say?

JPMorgan Expects E-Auction Prices To Remain Strong

Broking firm JPMorgan is "Overweight" on Coal India. It expects the company's ESG discount to reduce going forward as a strong global pricing environment for coal translates into strong earnings and elevated dividends.

The brokerage also expects the e-auction prices to remain strong for the company while an FSA coal price hike looks unlikely. It has highlighted new shutdowns that impact power sector demand, large write-offs related to power sector receivables as some of the key risks to its price target of Rs 285.

ICICI Direct Remains Positive

ICICI Direct maintained its buy rating on the stock with a price target of Rs 275. The firm expects Coal India's consolidated topline to have a compounded growth of 5.7 percent until FY24. It also expects consolidated EBITDA Margins of 30.3 percent this year and 26.5 percent in FY24.

A billion tonnes of coal every year in 3 years, Says Antique

Antique Stock Broking expects Coal India to reach closer to its one billion tonnes production target in FY25. It expects 12 percent and 22 percent compounded growth in revenue and EBITDA between FY21-24. It maintains its buy recommendation on the stock with a price target of Rs 294 per share.

First Published: Sept 21, 2022 9:14 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM