Indian equity benchmarks tanked in the last hour of trade in a volatile session on Tuesday amid a broad-based sell-off, tracking weakness across world markets. Globally, geopolitical tensions on account of the ongoing Russia-Ukraine war and rising COVID cases in China remained on investors' radar.

The Sensex ended 703.6 points or 1.2 percent lower at 56,463.2 and the Nifty50 settled at 16,958.7, down 215 points or 1.3 percent from its previous close.

Both indices tanked from the flatline in the last 40 minutes of the choppy session, having swung around 2.5 percent between gains and losses in intraday trade.

Investors lost Rs 3.4 lakh crore in wealth, as the market capitalsation of BSE-listed companies came down to Rs 266 lakh crore from Rs 269.4 lakh crore at the end of Monday's close.

The 50-scrip index -- closing below the 17,000 mark for the first time in one month -- has sunken below all of its six main moving averages in a bearish sign.

| Period (No. of days) | Simple moving average | Signal |

| 5 | 17,362.6 | Bearish |

| 10 | 17,605.6 | Bearish |

| 20 | 17,464.6 | Bearish |

| 50 | 17,140.9 | Bearish |

| 100 | 17,288.4 | Bearish |

| 200 | 17,170.4 | Bearish |

HDFC Life, HDFC, HDFC Bank, SBI Life, Tata Consumer, ITC and Cipla were the worst hit among the 44 laggards in the Nifty50 basket.

| Stock | Change (%) | Price |

| ADANIPORTS | -3.8 | 811 |

| CIPLA | -3.8 | 988.8 |

| ITC | -4 | 259.3 |

| TATACONSUM | -4.2 | 788 |

| HDFCBANK | -4.3 | 1,335 |

| SBILIFE | -4.5 | 1,121 |

| HDFCLIFE | -5.5 | 543 |

| HDFC | -6.3 | 2,121.8 |

On the other hand, Apollo Hospitals, Coal India, Reliance Industries, BPCL, ICICI Bank and ONGC were the only gainers, rising between 0.2 percent and 5.3 percent.

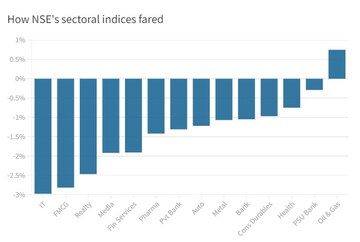

A sell-off across most sectors pulled the headline indices lower, with financial, IT, FMCG and auto stocks being the biggest drags.

The Nifty IT index fell three percent, taking its loss to eight percent in two days.

Mindtree shares fell by Rs 322.1 or 8.1 percent to close at Rs 3,638.7 apiece on BSE, despite the announcement of a strong set of financial results for the period between January and March by the IT firm the previous day.

So what's spooking the market?

A combination of factors has been hurting the sentiment on Dalal Street in the recent past.

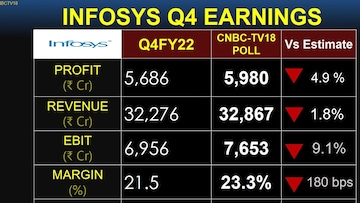

The corporate earnings season has gotten off to a disappointing start, with the financial results of index heavyweights HDFC Bank and Infosys missing Street estimates on multiple parameters.

The January-March earnings of TCS were a mixed bag. The country's largest software exporter missed Street expectations on the net profit front, though its topline exceeded estimates.

Foreign institutional investors (FII) net sold Indian shares worth Rs 5,871.7 crore on Tuesday -- a day after the highest single-day outflow since March 8, according to provisional exchange data.

As of Tuesday, FIIs have withdrawn a total Rs 26,458.4 crore from Indian shares in eight consecutive sessions. Domestic institutional investors (DIIs), however, have made net purchases to the tune of Rs 11,498.2 crore.

| Date | Net sale/purchase | |

| FII | DII | |

| Apr 18 | -6,387.5 | 3,342 |

| Apr 13 | -2,061 | 1,410.9 |

| Apr 12 | -3,128.4 | 870 |

| Apr 11 | -1,145.2 | -486.5 |

| Apr 8 | -575 | -16.5 |

| Apr 7 | -5,009.6 | 1,774.7 |

| Apr 6 | -2,280 | 622.9 |

FIIs had powered the near one-sided rally in benchmark indices to a chain of unprecedented levels till October 2021. They have been broadly net sellers of Indian shares since.

Fears of inflation and aggressive hikes in pandemic-era interest rates continue to spook investors and businesses globally, including companies operating in the IT, FMCG and banking spaces.

It is a double whammy for FMCG companies, which have been struggling against low demand and a multi-fold surge in input costs for several months.

Crude oil prices remained in triple-digit dollars per barrel, with benchmark Brent futures hovering around the $113 a barrel mark on Tuesday. India meets the lion's share of its oil requirement through imports.

Mayuresh Joshi of William O'Neil told CNBC-TV18 that a lot of Southeast Asian and Asian markets tracked by the brokerage are coming under a huge amount of pressure. "We have actually downgraded a few of the markets," he said.

He said Japan, Taiwan, Korea and China have been downgraded because of certain factors on the macro scale, he said.

Global markets

Equities across Europe fell in early hours. The pan-European Stoxx 600 index was down 1.2 percent at the last count.

S&P 500 futures were down 0.1 percent, suggesting a sluggish start ahead on Wall Street.

First Published: Apr 19, 2022 3:40 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM