Domestic Brokerage firm Prabhudas Lilladher believes that Chalet Hotels is the stock that is best placed to ride the hotel industry upcycle. It has initiated coverage on the stock with a buy rating and a price target of Rs 455. The price target implies a potential upside of 38 percent from Tuesday's closing levels.

Prabhudas Lilladher has cited two reasons behind why Chalet is the best placed among its peers - First, it has a strategically located, metro-centric hotel portfolio and second, it has the requisite pricing power amid affiliation with marquee global brands like Marriott and Novotel.

The brokerage also noted that Chalet Hotels as plans to add 88 and 168 rooms respectively in Pune and Hyderabad which, according to them, will not only improve its RevPAR (Revenue Per Average Room) but also drive a 12 percent compounded annual growth rate in hotel revenues until financial year 2025.

Chalet Hotels' annuity business is likely to grow at a CAGR of 78 percent until financial year 2025, as it adds 1.4 million square feet of leasable area in Mumbai and Bangalore, according to Prabhudas Lilladher.

The brokerage expects revenue and net profit compounded annual growth rate of 19 percent and 68 percent respectively until financial year 2025.

In an earlier interview with CNBC-TV18 in August, Chalet Hotels’ MD and CEO Sanjay Sethi had also said that the outlook for the hotel industry in India looked robust. “Next year looks like quite a phenomenal year on the rate growth front with most of the hotel companies targeting RFP (request for proposal) rates at 30-40 percent higher than the pre-pandemic rates,” Sethi had said.

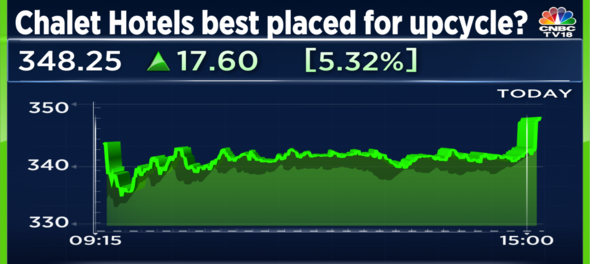

Shares of Chalet Hotels are trading 4 percent higher at Rs 343.60.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Yadav family members in focus in third phase of Lok Sabha polls in Uttar Pradesh

May 6, 2024 12:59 PM

Haryana Lok Sabha elections 2024: Seats, schedule, Congress-led INDIA bloc candidates and more

May 6, 2024 12:09 PM

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM