In a tumultuous market environment where most stocks experienced a decline,

Castrol India stood out as a notable exception, demonstrating a positive trend with an increase of approximately 2-2.5 percent. This growth was further accompanied by robust trading volumes, nearly three times higher than the previous two weeks combined.

While this performance is encouraging in the short term, it is essential to examine the stock's long-term trajectory, which has been marked by underperformance. This article delves into the recent developments in Castrol India's stock and explores factors that could potentially impact its future performance.

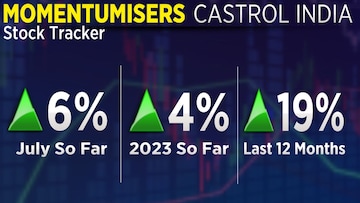

When considering Castrol India's long-term performance, it becomes evident that the stock has struggled to keep pace with the market. As of June, the stock experienced a modest gain of 6 percent, and throughout 2023, it has seen an overall increase of approximately 4 percent. Remarkably, up until the start of June, the stock had actually incurred losses for the year. Over the past 12 months, Castrol India's rally has been moderate, with a modest increase of around 19 percent.

Furthermore, the stock remains approximately 6.5 percent below its 52-week high, indicating ongoing challenges in achieving sustained growth.

Despite its long-term underperformance, Castrol India has shown signs of recovery from its recent lows. It has managed to recoup approximately 20 percent from its 52-week low, indicating an upward trend in the stock's value. This rebound could be attributed to several factors, including increased interest and positive sentiment surrounding the auto sector, of which Castrol is a part.

The surge in various

auto, auto ancillary, and tyre stocks has positively impacted Castrol India. As a company closely associated with the auto sector, Castrol stands to benefit from this trend. Moreover, the stability in crude prices has provided a favorable environment for the company. By closely monitoring key factors such as trading volumes, profit margins, and potential market share improvements, investors and market watchers can gain insights into the stock's future performance.

With the auto industry performing well and raw material prices stabilizing, market observers are keen to determine if Castrol India can maintain its positive momentum. The company's ability to leverage its association with the thriving auto sector, coupled with steady crude prices, presents an opportunity for growth. Market participants will closely watch for indications of improved trading volumes and margins, as well as any signs of market share expansion for Castrol India.

While Castrol India demonstrated strength amidst a market decline, its long-term performance continues to be a concern. The stock's recent gains of around 2-2.5 percent and significant trading volumes indicate short-term promise. However, the stock's underperformance in the longer term, with a modest increase of 4 percent in 2023 and 19 percent over the last 12 months, highlights the challenges it faces.

With the auto sector performing well and stable crude prices, Castrol India has the potential for a positive trajectory, but market participants will be closely monitoring key factors to gauge the company's future performance. For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)