The current bull run in the market is reminiscent of one seen in the early 2000s, according to Raamdeo Agrawal, Chairman of Motilal Oswal Financial Services.

"Between 2003 and 2008, when the bull market happened out of complete despondency in 2002-2003, post 9/11, the feeling was the same," Agrawal, who remains bullish on the market from a medium-term perspective, told CNBC-TV18.

"There was a lot of apprehensions whether the market is going to expand or not, how big the run is because you don’t know how big it becomes. In the beginning, you are always apprehensive, earnings are not there, the economy is in bad shape, so something or other is there which keeps a lot of people disappointed," he said.

The remarks from the market veteran come at a time when benchmark indices are scaling new peaks almost every day amid broad-based gains with no signs of fatigue.

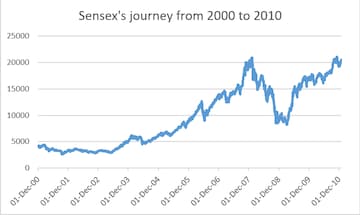

Following a decline of 18 percent in 2001, the Sensex index returned 3.5 percent in 2002 and made a comeback with a whopping 73 percent return the following year. In the following two calendar years, Sensex returned 13 percent and 42 percent.

Dalal Street has broken a series of records over the past few weeks, with benchmark indices Sensex and Nifty on Monday touching the 58,500 and 17,400 levels for the first time ever respectively.

It is up more than 51 percent in the past year and nearly 22 percent in 2021 alone so far.

The latest leg of the rally is backed by optimism on earnings, economic recovery and vaccinations to curb the spread of the coronavirus pandemic. Any signs of tapering of the massive stimulus in the US along with the numbers of the Delta Covid variant infections are keeping investors cautious, according to analysts.

Here's how the 30-scrip benchmark has fared in the past year:

The latest all-time highs come days after the 50-scrip gauge took less than 20 trading sessions to cover a distance of 1,000 points after scaling Mount 16k for the first time ever. Sensex touched the 16,000-mark in intraday trade for the first time on August 3, 2021, and broke above 17,000 on August 30.

The market expert expects the Indian market to continue to do well in the medium term.

"The real disturbance is on the logistics side where things like container and transport are becoming difficult and expensive; I do not know how it will play out, but it looks like a huge risk for a lot of companies and beneficial to some other companies,” Agrawal said.

He said the market looks good for the next 2-3 years. "Let's see where it goes... There are already signs of overrating but I feel comfortable," said Agrawal.

ALSO READ

Speaking on commodities, Agrawal said the spike in prices will be a risk for consuming industries. There is good demand for metal companies, he added.

"If steel prices don't see a big correction, companies will have healthier balance sheets," he said. Auto companies may continue to face headwinds in the near term with the impact of rising input and insurance costs along with supply-related issues.

Agrawal also said he expects consolidation in realty stocks. He is positive about the outlook of large real estate companies.

First Published: Sept 6, 2021 1:17 PM IST