Over the last two months, Indian markets have seen heavy pressure from foreign investors, domestic slowdown, macro cues and bleak corporate earnings. During this period, large cap stocks have continued rising, however, small and mid caps have seen a substantial fall.

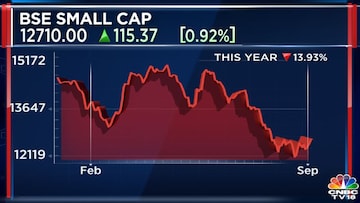

In 2019, BSE Smallcap and BSE Midcap have taken a nearly 13 percent hit as compared to the BSE Largecap. The BSE Smallcap index has fallen 13.93 percent while the BSE Midcap index has tumbled 12.52 percent this year so far. Meanwhile, BSE S&P Sensex rose 2.99 percent year-to-date (YTD).

Furthermore, both the BSE Smallcap and Midcap indices touched their 52-week low on August 23, 2019.

BSE Small Cap Index

BSE Small Cap Index BSE Mid cap Index

BSE Mid cap IndexThe BSE Midcap and Smallcap indices started falling in January 2018 and have plunged 25.7 and 36.5 percent respectively since.

Domestic retail investors prefer to invest in small caps and mid caps, therefore factors affecting Indian markets negatively will always result in decline in these two indices. On the other hand, large caps are generally bought by foreign investors heavily as a result it takes longer and bigger concerns for this index to fall.

As long as Indian market sentiment remains under pressure, retail investors will continue to sell in mid and smallcaps, casting a pall of doom on the two indices.

An Equirus Capital report stated that relative valuations indicate that mid and smallcap underperformance is unlikely to continue which has led them to give higher weightage to small and midcap stocks in their portfolio.

Though the broader markets are starting to see a recovery, largecaps remain the preferred choice for investors. From a strategy perspective, Equirus recommends going overweight on our small and mid-cap as well as on sectors like BFSI, pharmaceuticals, and metals.

First Published: Sept 11, 2019 9:12 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM