The macro environment for

oil marketing companies (OMCs) has been witnessing considerable improvement currently and it makes these stocks very promising, says Harshvardhan Dole, VP-Institutional Equities at IIFL, expressing his optimism for the oil and gas sector as a whole.

Emphasising his preference for OMCs over other companies within the industry, Dole highlighted his favourable view on Bharat Petroleum Corporation Limited (BPCL) as it is the most promising among the lot.

“We like OMCs over all other players in the sector. In general we like OMC as an asset class and we remain bullish,” he said.

In an interview with CNBC-TV18, Dole noted that the macro environment for OMCs has seen significant improvement. Various factors have contributed to this positive shift, including the government's efforts towards energy transition. In the recent budget, the government allocated a substantial expenditure of Rs 30,000 crore specifically for

OMCs, further bolstering the sector's growth prospects.

“Among the three, we like

BPCL the most, followed by Indian Oil Corporation (

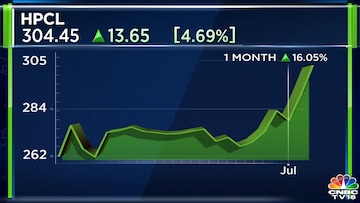

IOC) and Hindustan Petroleum Corporation Ltd (

HPCL),” he added.

Dole further discussed the impact of crude oil prices on OMCs. He suggested that if

crude oil prices remain within the range of $70-75 per barrel, OMCs are poised to continue their impressive performance. Stable oil prices within this range would enable OMCs to maintain healthy profit margins, translating into a robust financial performance. The sector's profitability is heavily influenced by the cost of crude oil, making the forecasted price range a crucial determinant of

OMCs' success in the near term.

“Our view on oil price is that while oil may not see a runaway increase, it may not fall substantially unless the global consumption deteriorates or worsens. So if oil remains anywhere between $70 per barrel and $75 per barrel, it is a goldilocks situation for OMCs in general. To that extent, we are forecasting record high profits in quarter one and a stellar performance in FY24,” he mentioned.

Based on the positive macro environment and the expected stability in crude oil prices, Dole projected that OMCs are likely to achieve record profits in the first quarter of the financial year 2023-24 (Q1FY24).

“The macro environment for OMCs has improved considerably,” he said.

This optimistic outlook underscores the favorable conditions for the sector, indicating the potential for substantial growth and financial success in the coming months.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)

First Published: Jul 6, 2023 11:53 AM IST