British American Tobacco (BAT) on Tuesday (March 12) said the company will sell up to 3.5% of its stake in ITC through block deals, offering shares at a price range of ₹384-400.25 per share.

This represents a 5% discount to the current market price (CPM). The deal is estimated to be worth ₹16,775 crore. The offering includes a lock-in period of 180 days, during which BAT will refrain from further selling its stake in ITC.

BAT currently holds a 29% stake in ITC, as per its shareholding pattern from the December quarter. It will be the third multinational corporation to sell stake in its Indian arm this year to cash in on high valuations. Whirlpool sold 24% in Whirlpool India and Timken sold 8.4% in its Indian subsidiary.

CNBC-TV18 was the first to report on February 8 that BAT, the largest ITC shareholder, is looking to monetise some of its stake. BAT said it has significant shareholding in ITC and that offers an opportunity to release and reallocate some capital.

BAT has been a shareholder in ITC in some way or the other since the early 1900s and has been subject to numerous share capital changes and regulatory restrictions. ITC was also part of CNBC-TV18's Dealing Room Chatter on Monday (March 11), where it was reported that a large block deal is likely to take place in the stock soon.

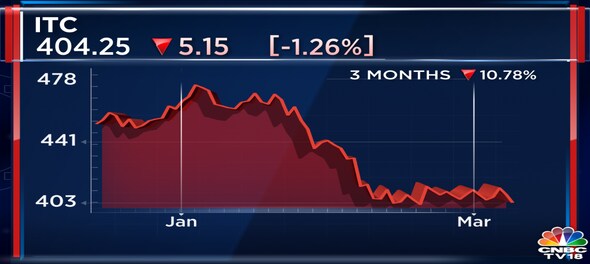

In a note on February 29, brokerage firm Goldman Sachs wrote that weak near-term earnings and an overhang from the BAT stake sale have been the key drivers behind the correction in ITC's stock price.

Goldman Sachs mentioned that while the cigarette volumes may recover in the March quarter, the paper business may turn out to be a near-term earnings drag, and a potential recovery is likely only in the September quarter of financial year 2025.

Shares of ITC ended at ₹404.25, down by ₹5.15, or 1.26%, on the BSE.

First Published: Mar 12, 2024 6:15 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM