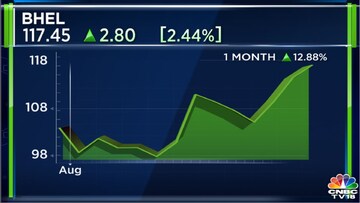

Shares of Bharat Heavy Electricals Ltd (BHEL) have embarked on an impressive run, soaring by nearly 9 percent, over the last two trading sessions. This bullish momentum has extended into the third consecutive day.

The last time the stock reached such heights was on May 11, 2017. However, it's important to note that

BHEL is still quite a distance away from its all-time high of Rs 345.30, which it achieved in December 2007.

What's driving this remarkable resurgence in BHEL's stock price? A significant factor is the company's robust technical position. The stock is comfortably trading above its 50-day moving average (DMA), 100-DMA, and 200-DMA. In the past year alone,

BHEL's stock has nearly doubled, registering an impressive 95 percent increase.

But what's truly exciting investors is the company's recent order inflow. BHEL has been on the receiving end of substantial orders. Just last week, the company secured an order from

NHPC worth over Rs 2,240 crore. Another substantial order came from the Mahan Thermal Power Project, amounting to over Rs 4,000 crore. This translates to a staggering total of almost Rs 6,200 crore in orders received in just one week.

These large order inflows come on the heels of BHEL's lackluster performance in the first quarter of FY24, marked by weak execution. However, the company managed to counterbalance this with its impressive order inflow, totaling Rs 15,600 crore. As a result, BHEL's order book now stands at an impressive figure in excess of Rs 1 lakh crore.

For more details, watch the accompanying video