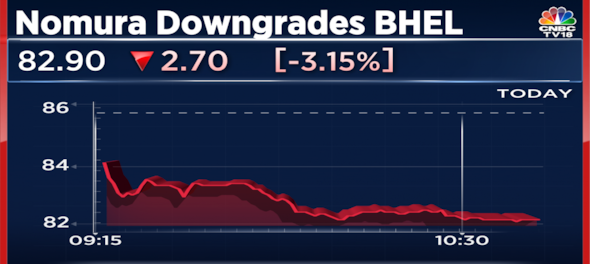

Shares of Bharat Heavy Electricals Ltd. (BHEL) fell over 3 percent on Tuesday after brokerage firm Nomura downgraded the state-run entity to reduce from its earlier rating of neutral. It also slashed its price target on the stock to Rs 61 from Rs 65 earlier.

Nomura believes that the recent orders bagged by the company appear to be aggressive and that limit the scope of a recovery in gross margin. BHEL, in a consortium with Titagarh Wagons Ltd., bagged orders worth Rs 23,500 crore for 80 Vande Bharat trains. The company’s scope of work includes electrics and the control systems and the bogies, BHEL told analysts in a conference call.

As a result, Nomura has cut BHEL's operating profit or EBITDA estimate for financial year 2024 and 2025 by 13 percent and 4 percent respectively, to factor in the delay in order inflow and still weak gross margin.

BHEL's operating cash flow (OCF) has turned negative in financial year 2023 with a substantial rise in contract assets.

On the flip side, brokerage firm Antique Stock Broking projected that BHEL earnings will grow five-fold between financial year 2024-2026, helped by strong ordering, improved execution, and the benefits of operating leverage.

The company’s order book as of March 31, 2023, was at Rs 91,336 crore. The company secured the Vande Bharat order after the start of the financial year 2024.