It was a fourth straight week of gains for Dalal Street, as broad-based buying helped Indian equity benchmarks scale new highs. Banking, IT and automobile stocks helped Sensex surpass the 59,000 mark and Nifty50 take out 17,500 decisively. Financial services shares were in high demand amid hopes of faster resolution of stressed assets ahead after the Cabinet gave nod to the setting up of the country's first 'bad bank’.

For the week, the Sensex index rose 710.8 points or 1.2 percent to 59,015.9, and the 50-scrip benchmark climbed 215.9 points to 17,585.2.

The week began with official consumer inflation staying within the Reserve Bank of India's comfort zone.

The Cabinet approved a relief package for the ailing telecom sector, and Rs 26,000 crore in production-linked incentives for the auto sector though only for manufacturers of electric and hydrogen fuel cell vehicles.

Most telecom stocks jumped, giving BSE's telecom index a 6.7 percent lift. Bharti Airtel added 6.1 percent to its value for the week while Vodafone Idea spiked 33.1 percent.

Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Eicher Motors, Hero MotoCorp and Bajaj Auto rose up to five percent.

The Nifty Bank index finished the week with a gain of 1,128.8 points or 3.1 percent at a record closing high. The government said it will guarantee up to Rs 30,600 crore for security receipts issued by the National Asset Reconstruction Company Limited (NARCL).

A rally in Zee Entertainment shares led media stocks higher, propelling the sectoral index's 13.3 percent surge.

FMCG giant ITC clocked a weekly gain of 8.7 percent after its shares saw the best day in 16 months on Thursday.

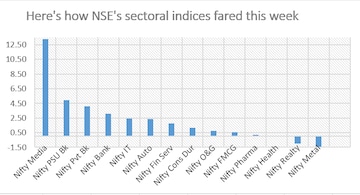

The media index was once again the top weekly performer among NSE's sectoral gauges. The Nifty Metal and Realty indices bucked the trend, suffering weekly losses of around one percent each.

Among blue-chip stocks, IndusInd Bank, Kotak Mahindra Bank, ITC, NTPC and Bharti Airtel were the biggest gainers for the week. On the other hand, Bharat Petroleum, Tata Steel, HUL, UltraTech and UPL were the worst hit among the 19 laggards in the Nifty50 universe.

Nifty gainers

| Stock | Weekly change (%) |

| IndusInd Bank | 13.1 |

| Kotak Mahindra Bank | 10.5 |

| ITC | 8.7 |

| NTPC | 8.0 |

| Bharti Airtel | 6.1 |

| Coal India | 5.4 |

| HCL Tech | 5.4 |

| SBI | 5.0 |

| Hero MotoCorp | 4.8 |

| Indian Oil | 4.8 |

Nifty losers

| Stock | Weekly change (%) |

| Bharat Petroleum | -11.2 |

| Tata Steel | -4.2 |

| HUL | -3.2 |

| UltraTech | -2.9 |

| UPL | -2.1 |

| Grasim | -1.8 |

| Reliance Industries | -1.5 |

| Nestle | -1.4 |

| Asian Paints | -1.3 |

| JSW Steel | -1.0 |

Broader indices supported gains in the overall market for yet another week. The Nifty Midcap 100 gauge outperformed the headline index with a 1.9 percent gain. Nifty Smallcap 100 rose 0.9 percent.

About 300 stocks on BSE 500 -- the broadest gauge on the bourse -- logged weekly gains.

Zee Entertainment, Zensar Tech, Dish TV, Uflex, Varroc, IFCI and SpiceJet -- rising between 12.8 percent and 39.6 percent -- were among the top gainers. Vaibhav Global, GSPL, CreditAccess, Sequent Scientific, Aegis, Trident and Caplin Point -- down between 6.7 percent and 29.2 percent -- were among the top losers.

Globally, investors remained cautious after data showing weakness in China's economy raised concerns about a global recovery. A weaker-than-expected reading of US consumer prices shifted focus to the Federal Reserve's meeting next week.

The road ahead

Analysts await key policy meetings of central banks including the Fed due in the coming week.

"With weak US job data and inflation increasing at a slower pace, the Federal Reserve is not expected to give hints on its plan to taper stimulus in the upcoming meeting," said Vinod Nair, Head of Research at Geojit Financial Services.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM