Shares of private lender Bandhan Bank dropped nearly 6 percent on Wednesday after it reported weak business update in first quarter and chief financial officer (CFO) Sunil Samdani resigned. The lender's loan growth moderated and recoveries fell sequentially in the quarter ended June. Brokerages have, however, given 'buy' rating to the lender.

A buy rating is a recommendation to purchase a specific stock. This rating implies that analysts expect the price of a stock to move higher in the short- to mid-term.

Bank's Q1 update

Talking about lender's first quarter business update, the total advances rose 6.7 percent year-on-year (YoY), however, it fell 5.5 percent quarter-on-quarter (QoQ). The Current Account and Savings Account (CASA) Deposits of the bank was down 8 percent QoQ, and 2.8 percent YoY at Rs 39,076 crore, while its CASA ratio stood at 36 percent versus 39.3 percent QoQ, and 43.2 percent YoY.

The pan-bank collection efficiency increased to 98 percent in Q1 from 96 percent a year earlier but fell sequentially from 99 percent, the lender said in a regulatory filing.

(In Rs crore)

| June 30,2022 | March 31,2023 | June 30,2023 | YoY(%) | QoQ(%) | |

| (Approximate) | |||||

| Loans and Advances (On book + Off Book + TLTRO + PTC) | 96,650 | 1,09,122* | 1,03,169 | 6.7% | -5.5% |

| Total Deposits | 93,057 | 1,08,069 | 1,08,479 | 16.6% | 0.4% |

| CASA Deposits | 40,195 | 42,455 | 39,076 | -2.8% | -8.0% |

| Retail Deposits (incl CASA) | 72,950 | 76,944 | 77,239 | 5.9% | 0.4% |

| Bulk Deposits | 20,107 | 31,125 | 31,240 | 55.4% | 0.4% |

| Retail to Total Deposits (%) | 78.4% | 71.2% | 71.2% | - | - |

| CASA Ratio (%) | 43.2% | 39.3% | 36.0% | - | - |

(Source: Bandhan Bank's regulatory filing)

CFO's resignation

In another development, the bank's CFO Sunil Samdani resigned from the post to explore professional opportunities outside the bank. Samdani's last working day as the CFO and key managerial personnel of the bank would be September 30, 2023, the bank said.

Now, the lender is in the process of identifying a suitable candidate for the office of CFO and KMP, and the said appointment would be informed to the stock exchanges in due course.

What brokerages are saying

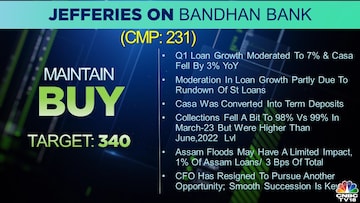

Research house Nomura has kept 'buy' rating on Bandhan Bank with a target at Rs 325 per share on the back of the CFO resignation and soft pre-Q1 update. Jefferies too gave a 'buy' rating to Bandhan Bank, with a target price of Rs 340 per share.

Nomura said that the bank has reported a decline of 5 percent in its loans growth compared to the previous quarter. The deposits growth is muted at 7 percent compared to the same period last year.

Jefferies added that the moderation in loan growth is partly attributed to the rundown of short-term loans. The bank converted some of its CASA deposits into term deposits.

"The recent floods in Assam are expected to have a limited impact on Bandhan Bank. The loans in Assam account for approximately 1 percent of the bank's loan portfolio or 3 bps of the total," it said.

A look at the stock performance

Bandhan Bank has underperformed NIFTY and Bank NIFTY in last one week as well as one month.

In one week, the stocks have dropped 0.84 percent, while Nifty surged by 2.2 percent. Bank Nifty is also positive at 1.24 percent. The lender has dropped 12.1 percent in one month, while Nifty and Bank Nifty are positive at 4.28 percent and 2.72 percent respectively.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!