Private sector lenders Axis Bank and ICICI Bank have been proactive in adapting to changing market dynamics and have made significant investments in technology and digital banking infrastructure. As a result, they are well-prepared to capture opportunities in the evolving financial landscape.

Furthermore, both

Axis Bank and ICICI Bank have shown remarkable resilience in managing their asset quality and provisioning during challenging economic conditions. Their ability to navigate turbulent times with a strong focus on risk management has garnered the confidence of investors.

In an interview with CNBC-TV18, Dhiraj Agarwal, Managing Director of Ambit Capital emphasized that while other large-cap banks are undoubtedly formidable, Axis Bank and

ICICI Bank appear to be able to outperform their peers in the coming months.

He pointed out that the valuations of these major banks (top 4 banks) are converging, and there is the potential for them to converge even further. However, Agarwal believes that Axis Bank and ICICI Bank might have the upper hand in this equation.

“We have compared the matrices of the top four large cap banks, they look very similar, and the valuations are converging; they could converge a bit more. So, for some more time to come, Axis Bank and ICICI Bank could end up outperforming the other two,” he said.

On July 26, Axis Bank announced a significant 40.5 percent increase in its year-on-year (YoY) net profit, reaching Rs 5,797 crore for the

first quarter ending on June 30, 2023.

Comparatively, during the same quarter in the previous year, Axis Bank had reported a net profit of Rs 4,125.3 crore, as disclosed in a regulatory filing. Forecasts from CNBC-TV18 Polls had anticipated a quarterly profit of Rs 5,961.1 crore for the period being evaluated.

Furthermore, ICICI Bank revealed a

first-quarter net profit of Rs 9,648 crore for FY23-24, demonstrating a strong year-on-year increase of 39.7 percent, which exceeded the forecasts of financial experts.

The financial performance of ICICI Bank in Q1 exceeded the projections made by a consensus poll of three brokerage firms. According to information from Moneycontrol, the poll had suggested a 29.5 percent increase in net profit for the June quarter, amounting to Rs 8,982 crore compared to the same period the previous year (with a slight 5.1 percent decrease on a quarterly basis).

For the preceding quarter, Q4FY23, ICICI Bank had reported a net profit of Rs 9,121.9 crore, whereas during the corresponding quarter of the previous year, the profit stood at Rs 6,904.9 crore.

For more details, watch the accompanying video

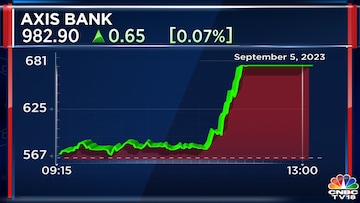

First Published: Sept 5, 2023 4:10 PM IST