Shares of AU Small Finance Bank (SFB) slumped more than 5 percent on Wednesday, a day after the lender posted its quarterly numbers.

At 1124 IST, the stock was trading 3.6 percent lower at Rs 1,364.7 on BSE. Year-to-date, the stock has run up 31 percent and 112 percent in the past three years.

AU Small Finance Bank shares touched an intraday low of Rs 1,339.85, down 5.4 percent, on BSE today.

AU Small Finance Bank shares touched an intraday low of Rs 1,339.85, down 5.4 percent, on BSE today.AU SFB’s net profit soared 105 percent to Rs 346 crore in the quarter ended March 2022, supported by lower provisioning for bad loans and improvement in a business scenario. The lender had posted a net profit of Rs 169 crore in the same quarter last fiscal.

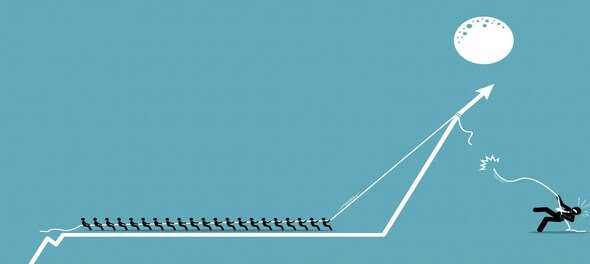

However, despite strong March quarter earnings, shares of the Jaipur-based small finance bank reacted negatively.

“All positives, including strong quarterly numbers, have already been factored in AU Small Finance Bank’s shares,” said Ajit Mishra, Vice-President of Research, Religare Broking.

Some market participants also believe that the overall weakness in the banking, financial services and insurance (BFSI) space, as well as the broader market, has also dampened investors’ risk appetite for financial services stocks, especially in the mid and small-cap space.

Also Read |

The Net Interest Margin--the difference between interest paid and interest received--during the reporting quarter improved to 6.3 percent from 5.7 percent in the year-ago period. Further, the cost of funds for the bank also reduced to 5.7 percent from 6.5 percent.

Meanwhile, the asset quality of AU SFB witnessed a significant improvement with the Gross Non-Performing Assets (NPAs) falling to 2 percent of the gross advances as of March 31, 2022, from 4.3 percent a year ago. Likewise, the net NPAs came in at 0.5 percent from 2.2 percent.

Also, there was the highest ever quarterly disbursement of Rs 10,295 crore in March 2022, up by 39 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP is planning to ban RSS, says Shiv Sena (UBT) chief Uddhav Thackeray

May 18, 2024 8:01 PM

Punjab Lok Sabha elections: Complete list of Congress candidates

May 18, 2024 4:08 PM

Punjab Lok Sabha elections: Check full list of AAP candidates and constituencies

May 18, 2024 12:59 PM

PM Modi, Rahul Gandhi election rallies in Delhi today: Here are the routes to avoid

May 18, 2024 11:28 AM