Most Adani group shares declined more than 3 percent on Monday after the two group companies of the billionaire Gautam Adani-led conglomerate announced plans to raise up to Rs 21,000 crore from qualified institutional players.

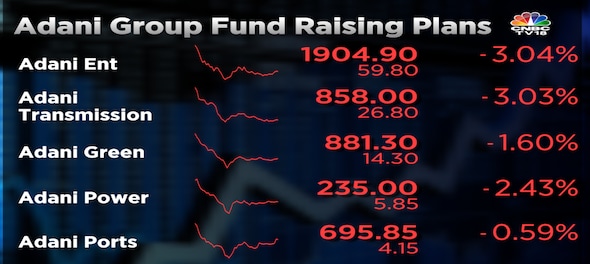

The stock of Adani group flagship company Adani Enterprises and Adani Transmission declined 3 percent each in opening trades.

Other group companies were also trading with losses between 1-2 percent.

Adani Enterprises at its board meeting on Saturday approved a proposal to raise up to Rs 12,500 crore, while Adani Transmission's board approved raising Rs 8,500 crore through a QIP issue.

The board of another group company Adani Green Energy was scheduled to meet on May 13 to take a decision on the fundraising, but the meeting was postponed to May 24.

Adani group companies would seek shareholders’ approvals for the proposed fundraising through QIP issues.

Earlier in February, Adani Enterprises aborted its plans to raise Rs 20,000 crore through a follow-on public offer after a damning report by US-based short seller Hindenburg Research in January triggered a massive sell-off in group companies. The short-seller in a report had alleged stock manipulation and accounting fraud by the Adani group.

“Things have been kind of settling down for the Adani Group, especially after GQG’s investment gave its shares a strong backing,” Kranthi Bathni, director at WealthMills Securities Pvt. told Bloomberg. “Raising fresh funds also provides comfort to lenders.”