ABB India has seen a big upmove in the past few months. The stock is up 22 percent in the past month, 55 percent in the past six, and has rallied 76 percent in the last year. Considering the run-up valuations, brokerage house Credit Suisse has downgraded the stock to 'underperform' going ahead from their earlier 'neutral' stance.

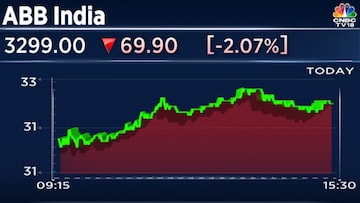

The revised target price is at Rs 2,600 versus the current value of approximately Rs 3,275 per share.

Credit Suisse has noted that there is evidence of the investment cycle picking up but after the sharp run up, the stock is now trading at over 70 times FY23 price to earnings, which implies a much higher expectation from the street.

Even on a discounted cashflow (DCF) model, the brokerage house sees a 20 percent compounded annual growth rate (CAGR) versus the all-time high margin of 20 percent.

Within that investment cycle space, the brokerage firm still has an overweight rating on Larsen and Toubro (L&T) and prefers Siemens over ABB from a valuation point of view.

Watch the accompanying video of CNBC-TV18’s Nimesh Shah for more details.

To watch other videos in this series, click on the Standout Brokerage Report tab below.

(Edited by : Abhishek Jha)