Investors turned wealthier by Rs 2.2 lakh crore on Wednesday, June 28, as equities rallied to hit record highs, lifted by gains in some stocks of the Adani group and heavyweight financials on the back of strong institutional flows, healthy macros and robust earnings growth.

India's blue-chip Nifty 50 and Sensex touched record closing highs, with the Nifty ending below the psychologically-important level of 18,972.10 points with 0.8 percent gains and the Sensex settling 0.79 percent higher at 63,915.42.

During the day, the Nifty50 surged as much as 1.03 percent to an all-time high of 19,011.25, after struggling to breach the level last week amid hawkish central bank commentary.

Today's market rally added Rs 2.2 lakh crore of wealth to investors' kitty, and the bulls are still counting money. The market capitalisation of BSE-listed companies surged to Rs 294.33 lakh crore from Rs 292.13 lakh crore in the previous trading session.

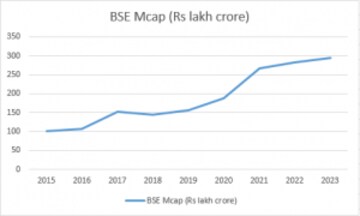

Since 2015, the market cap of BSE-listed companies, also an indicator of notional wealth of investors, has risen three-fold. The BSE market value stood at Rs 294 lakh crore as of Wednesday's closing, which is 2.94 times higher than Rs 100 lakh crore eight years ago.

Twelve of the 13 major sectoral indices rose, with financials climbing 0.54 percent. Adani Enterprises, the Nifty's top gainer, rose over 5 percent on a report that GQG Partners and other investors bought around $1 billion of additional stake in the conglomerate's firms.

Index heavyweights HDFC and HDFC Bank extended gains after announcing plans to complete their proposed merger on July 1.

"Strong institutional flows, healthy macros, and robust earnings growth drove the domestic market toward its new highs. Further, robust US consumer and home sales data soothed investors’ sentiments. With the onset of the monsoon and RBI taking a rate pause, we expect market momentum to continue and remain buoyant," said Siddhartha Khemka, Head of Retail Research at Motilal Oswal.

What lies ahead for Nifty50

The Nifty50 has risen to an unprecedented all-time high, propelled by the solid fundamentals of the Indian economy and consistent stability in global cues witnessed recently.

"The current market sentiment indicates a sustained structural bull run, making it difficult to assign an immediate target to this upward trend. However, it is worth noting that the levels around 19,000–19,191 could potentially serve as a resistance area, which might trigger profit booking from higher levels," said Santosh Meena, Head of Research at Swastika Investmart.

Conversely, on the downside, Meena said the immediate support level can be identified at 18,700, while 18,450 is expected to provide a substantial base for the market.

”Nifty made a new all-time high on June 28, triggered by buying from institutions and retail/HNI segments. Improving US economic data and hints from China about fresh stimulus measures have helped improve sentiments. Upside momentum could take Nifty even higher from here and if the El Nino fears subside, we may see a more sustainable up-move. India shines as an attractive destination for investors from across the globe offering steady growth, falling inflation, better external trade/services situation, improving corporate earnings trajectory, prudent growth enhancing and fiscal policies,” said Dhiraj Relli, MD and CEO at HDFC Securities.

(Edited by : Shoma Bhattacharjee)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM