Home

Terms and Conditions

Stock Market Highlights: Sensex and Nifty50 end lower amid choppy trade dragged by auto and financial shares

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on November 18, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Sentiments are positive for India: Anand Shah

"India is still a shining star and a couple of reasons for that - not only that India had not overspend during the COVID crisis, our fiscal deficits and forex reserves were still within benign limits. And to that extent, that's been helping today where we have been able to push for some growth at this point of time," says Anand Shah, Hd-PMS & AIF Investments ICICI Pru AMC. "China plus one, leading to some uptick in manufacturing more recently with high energy prices in Europe is also helping shift some weight of manufacturing from a high cost Europe towards India. So the sentiments are positive for India, while fundamentally still on the earnings front, things have softened in this quarter two than what it was till the last one," Shah adds.

Positive on PB Fintech, expect to grow at double the industry rate: Dipan Mehta

“I am positive on PB Fintech. It is an outstanding business, it is just that maybe valuations were a bit confusing and got listed at a valuation which perhaps it should not have. However underlying business fundamentals are great," says Dipan Mehta, Director Elixir Equities. "Insurance industry is going to grow gradually, at least double digit growth rates would be there. So you can expect PB Fintech to grow at double the industry rate. The company has a great technology platform which is unparalleled. The company is also looking at getting into profitability and that is positive news for their shareholders. So if someone wants an exposure to insurance sector per se then PB Fintech is quite an interesting bet but you can expect a lot of volatility in the stock price as well as in the earnings till the time it becomes a more mature business which is at least 3-4 years away.”

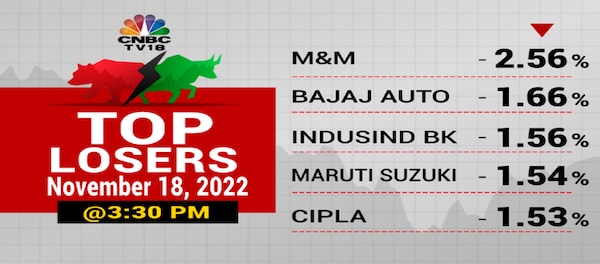

Sensex and Nifty end in red for third straight session

-- M&M, Bajaj Fin and ITC drag Nifty while HUL, SBI and HDFC lend support

-- Nykaa ends four percent higher after company’s 5.4 crore shares change hands in a block deal window

-- Eicher Motors slips 1.5 percent following appointment of Vidhya Srinivasan as CFO

-- Reliance recovers sharply in last hour after Jio launches 5G across Delhi and NCR

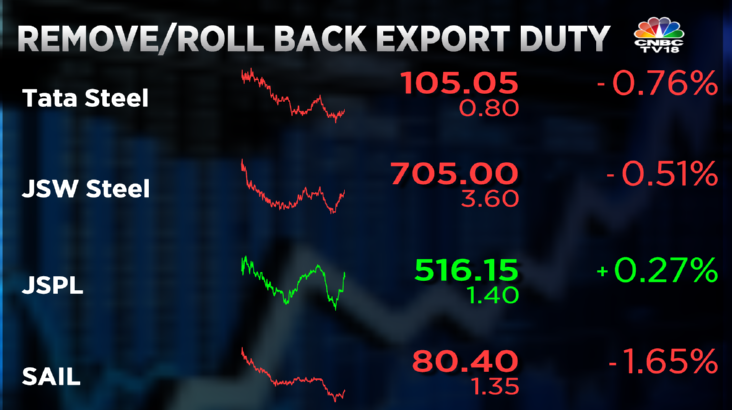

-- Steel companies recover after Steel Minister seeks Fin Min to reduce/roll back export duties

-- Glenmark Pharma slips five percent despite double-digit revenue growth guidance

-- ONGC ends one percent lower while Asian Paints rises one percent after brent slips below $90//bbl

-- Fortis slips 0.5 percent as SEBI advises open offer should proceed after Delhi HC order

-- Market breadth favours declines, advance-decline ratio at 1:2

ROAs are here to stay: Prakash Diwan

"The big change in key matrices does involve the ROA shift and that is something which is fairly secular. When it happened, the first time in a bank, like Canara Bank we thought this one off, but the way it's kind of getting to be replicated across some of the smaller banks as well, very clearly seems to indicate that this is a deep seated trend that will probably start being very favourably visible, going forward. Interestingly, what is happening is look at look at how PSU bank is now position, they know that they are challenging themselves with market share, credit growth, which is to keep pace with the private sector peers," says market expert Prakash Diwan. "ROAs are here to stay, and we will have to kind of all of us will have to rework our value book value estimates, and growth estimates basis that which means there is still much more legs to this rally that we have seen," Diwan adds.

Tata Motors is a long haul stock: Vijay Chopra

"If you look at the trajectory (of Tata Motors) in the last two years, it has revamped itself to be one of the best the one of the biggest EV players in the country. The market share presently is close to 60 percent and the new models which Tata’s are coming up with people are liking it, we are seeing more of TATA Safaris and more of Harriers on the road, and a lot of Altroz models are now visible on the road. Earlier they didn't have the repetition of designing. So they have actually worked on the product," says Vijay Chopra of enochventures.com. "I think JLR is the main reason why Tata Motors is not performing as of now. But I think as things improve in China, in Europe, JLR numbers would surely improve. Once that starts happening, I see Tata Motors going to maybe Rs 700, or even Rs 900. So, it's a long haul stock, if somebody is there for the short- term, I don't think that you can get excited about it. But yes, the management is also giving a great guidance that company is going to be debt free, they have been regularly reducing the debt to a great extent. So I think that Tata Motors is a good stock to have in a portfolio, but again, for the long haul; it might disappoint in the shorter term. But yes, in the longer term, I see levels of Rs 700 and even Rs 900," Chopra adds.

Buy Balkrishna Industries, Kotak Mahindra Bank, sell ITC: Hemen Kapadia

Here are some recommendations by Hemen Kapadia, KRChoksey Securities:

-- Buy Balkrishna Industries for a target of Rs 2,020 with a stop loss at Rs 1,945

-- Buy Kotak Mahindra Bank for a target of Rs 2,115 with a stop loss at Rs 1,925

-- Sell ITC for a target of Rs 331 with a stop loss at Rs 352

NBFCs will do well: Devang Mehta

"NBFC universe particularly the largecap banking as well as the largecap NBFC universe, the consumer NBFCs - I think all these companies will do well. Home improvement or building materials, typically in India has always been a consumption theme more or less. So my sense is also people are spending, residential real estate sales have been very robust. As a theme you can play home improvement, paints, ceramics, even cement to a certain extent, which has shallow cyclicality looks good for the next couple of years," says Devang Mehta, Head Equity Advisory, Centrum Wealth Management.

Lot of opportunities emerging out of the earnings season: Devang Mehta

"My sense is that all-time highs are just in sight. It's just an illusion for markets but otherwise there are a lot of opportunities emerging out not only out of the earnings season, but also from the Indian macros and micros, a lot of things would emerge out and for somebody who is in the longer haul has a lot of money to be made in the next two years," says Devang Mehta, Head Equity Advisory, Centrum Wealth Management.

Buy MGL, Birlasoft: Aditya Agarwala

Here are two recommendations by Aditya Agarwala of Invest4edu:

-- Buy MGL for a target of Rs 925 with a stop loss at Rs 875

-- Buy Birlasoft for a target of Rs 296 with a stop loss at Rs 271

Fear gauge VIX jumps 5.4%

The India VIX — which measures the expectation of volatility in the short term — rose 5.4 percent to 15.7 in choppy trade.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|