With the broader markets scaling newer highs day after day, there's a question that's been echoing in the minds of investors: Are we currently in the midst of a bubble or simply riding a bullish market? It's a million-dollar question, and the answer, it seems, can only be found in the rear view mirror of time. However, there are some intriguing indicators that suggest we might not be in a bubble just yet.

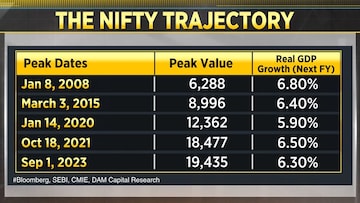

The debate between bubble and

bull market hinges on a few key data points, and the global influence on the market is one of them. If we take a closer look at the last four market peaks, they all had one thing in common: they were driven by significant global events. This phenomenon could be attributed to a combination of factors, including the dominance of Foreign Portfolio Investment (FPI) flows in the past (even though they are not as dominant today) and our twin deficit.

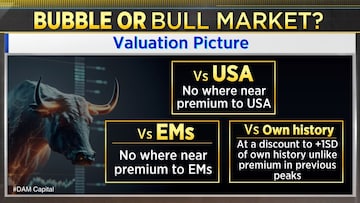

Based on the provided information, it appears that the current market conditions are not indicative of a bubble but rather suggest a more balanced or potentially bullish market. Here's a breakdown of the key factors:

Valuations

: The valuations of the market, when compared to the US market, other emerging markets (EMs), and its own historical performance, do not indicate an excessive premium or overvaluation. In fact, the market is currently at a discount to its own historical averages.

Momentum: Retail participation in the market has been increasing over time, especially after the COVID-19 pandemic. However, the level of retail participation at present is not significantly higher than the average, which suggests a more stable market environment.

Fear: The shift from equity to liquid funds, which is typically seen as a sign of fear in the market, is not as pronounced as in previous market peaks. This indicates that investors may not be panicking or rushing to exit equity positions.

Based on these factors, it seems that the market is not exhibiting the characteristics typically associated with a bubble, as per DAM Capital. Instead, it appears to be in a state of reasonable valuation, with steady retail participation and relatively low fear levels.

First Published: Sept 8, 2023 4:53 PM IST