The big event to watch over the next six to eight months is the general elections in 2024 to be held in April next year. Historically, the run-up to general elections has been a good period for infrastructure and capex-related companies. A lot of government spending generally happens in the run-up to the elections.

Gurmeet Chadha, Managing Partner & CIO of Complete Circle Consultants discussed if the Indian market is witnessing a repeat of the 2003-2007 investment cycle and the stocks or sectors that one needs to play in this theme.

“The world is not what it was in 2003-2007. All the trends – you see the figures coming from private players tell you that the investment cycle has kickstarted. It started by the government and now I think the private sector is getting into it,” he said.

The big themes he is looking at are capital goods, power, cement, utilities and infra, and home improvement.

Larsen and Toubro (L&T) is the stock he is focusing on within the capital goods sector. “You start with L&T but you have to go down the value chain and play the sector well,” he said.

He also likes Titagarh Wagons and ABB India from the capital goods space.

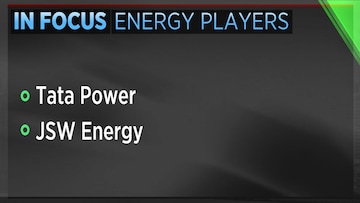

From the power sector, he likes Tata Power and JSW Energy.

According to him, one has to play the cement industry through both a large player as well as a turnaround story in case there is one.

“UltraTech Cement is a clear beneficiary. We like UltraTech and the one we like more is one of the turnaround story, risky bet, smallcap company called Sagar Cements,” he mentioned.

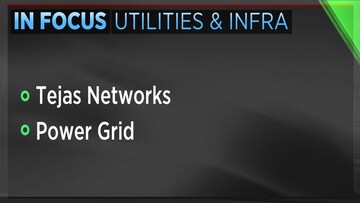

Infrastructure space has two elements, physical and digital. Chadha prefers digital infrastructure players such as Tejas Networks.

The government’s goal is to get to 500 gigawatts (GW) by 2030. Assuming they even get to 400-450 GW, it will be a huge capex spending in transmission.

“We like Power Grid as well,” he said.

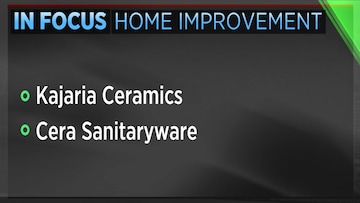

Chadha also continues to bet on the home improvement sector. He prefers players like Kajaria Ceramics and Cera Sanitaryware.

For more, watch the accompanying video