The current spike in the Indian market has legs — given that the worst of commodity inflation in the past six months is now behind — but it might peak out after rising 8-10 percent from current levels. That is the view coming in from Sandeep Bhatia, Head of Equity and Country Head-India at Macquarie Group.

Macquarie is betting big on Indian economy in the second half of the year ending March 2023. “We will probably go into the third quarter of the financial year quite strong,” Bhatia said in an interaction with CNBC-TV18.

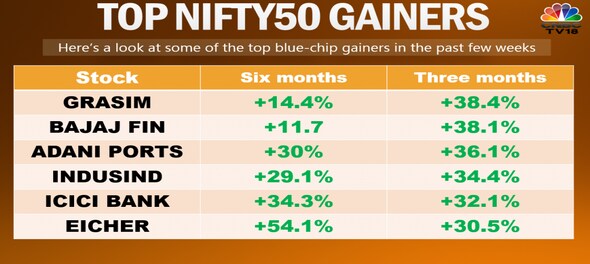

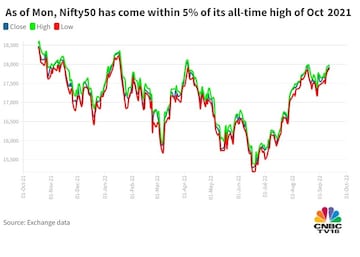

His remarks come at a time when the Indian equity market has come within five percent of its lifetime highs scaled in October 2021 — the last of a series of record levels touched during a liquidity-driven rally that stretched to 18-odd months.

On Tuesday, the Nifty50 crossed the 18,000 mark in intraday trade for the first time since April 5.

"To some extent, the only disappointment has been a weak monsoon... Broader industrial production consumption trends are still holding up," he said.

"To some extent, the only disappointment has been a weak monsoon... Broader industrial production consumption trends are still holding up," he said.

Bhatia of Macquarie sees earnings growth to the tune of 14-18 percent for the entire Nifty50 universe over the next two years. The real challenge, however, in his view will be the year after that.

He likes TCS, Infosys and HCL Tech, and the IT space as a whole where he sees "good value" at current levels. "Our call here is that we will continue to see decent earnings growth, of 10-12 percent, come through," said Bhatia, who believes the US will not have as severe a recession as in the previous cycles.

While the US market will likely remain stable, challenges for India IT will actually emerge from Europe, he warned.

Bhatia is not the only expert positive on the IT space, which is yet to reflect the overall recovery in the market for much of 2022.

Elixir Equities Director Dipan Mehta is bullish on midcap IT companies given their recent correction.

"They have been able to manage the environment far better than largecap IT companies... The likes of Tata Elxsi, LTTS, Mindtree. Persistent Systems and KPIT are all excellent companies. These corrections are good opportunities if you have a 3-5-year type of view," Mehta told CNBC-TV18.

Check out our in-depth Market Coverage

, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

(Edited by : Sandeep Singh)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Deve Gowda's son-in-law Manjunath to lock horns with Congress' DK Suresh

Apr 26, 2024 9:11 AM