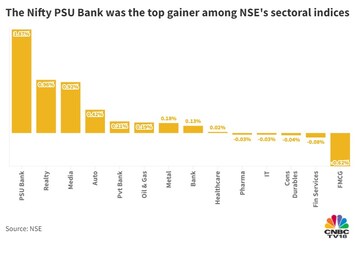

Indian equity benchmarks succumbed to selling pressure following a positive start on Friday, as Dalal Street entered a new monthly derivatives series after finishing the previous one more than four percent higher. Losses in IT, FMCG and consumer durable shares weighed on the market though gains in financial and oil & gas stocks lent some support.

Both headline indices slipped as much as 0.2 percent in the first few minutes of trade after scaling fresh 52-week highs. The Sensex dropped 148.8 points to 62,123.8 at the weakest level of the day so far — retreating 323.9 points from its intraday high. The Nifty50 slid to as low as 18,445.1, down 39 points or 0.2 percent from its previous close.

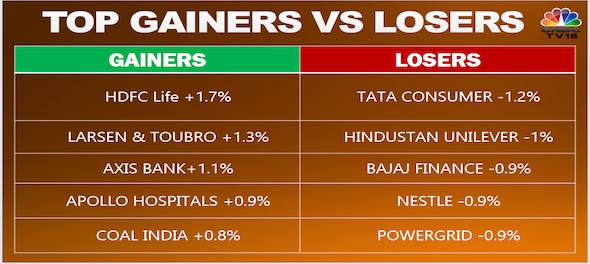

A total of 29 stocks in the Nifty50 basket struggled below the flatline in early deals. Tata Consumer, HUL, Bajaj Finance, Nestle, PowerGrid, Kotak Mahindra Bank, Asian Paints, Eicher, Britannai and Adani Enterprises — trading around one percent lower each — were the top laggards.

The HDFC twins, HUL and Kotak Mahindra Bank were the biggest drags on both main gauges.

On the other hand, HDFC Life, Larsen & Toubro, Axis Bank, Apollo Hospitals, Coal India, Bharat Petroleum, IndusInd, NTPC, ONGC and Maruti Suzuki — rising around 1-2 percent — were among the blue-chip stocks that rose the most.

The Nifty Bank — which has SBI, HDFC Bank, Kotak Mahindra Bank, ICICI Bank and Axis Bank among its 12 member stocks — gained as much as 0.6 percent to an all-time high of 43,339.2 during the session.

"Many favourable factors have come together to push the market to record levels: the FOMC minutes indicating smaller rate increases, the sharp correction in crude oil, FIIs turning buyers, reports of impressive credit growth and capex revival, and even the bad news of record COVID spread in China is turning out to be good news for India since it will accelerate the China Plus One policy," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Brent crude was steady at $85 a barrel, having retreated almost 39 percent from a peak in March. Lower oil prices are beneficial for India, which meets the lion's share of its petroleum requirement through imports.

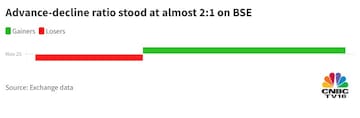

Overall market breadth was in favour of the bulls, as 1,911 stocks rose and 1,016 fell in morning trade on BSE.

Globally, concerns remained on the impact of steep hikes in COVID-era interest rates on economic growth.

Equities in other Asian markets largely fell, following the Thanksgiving holiday on Wall Street, with MSCI's broadest index of Asia Pacific shares outside Japan last seen trading 0.4 percent lower. Japan's Nikkei 225 was down 0.3 percent.

S&P 500 futures were up 0.2 percent, suggesting a mildly positive start ahead on Wall Street. On Wednesday, the three main US indices rose 0.3-1 percent after minutes of the Fed's last policy meeting hinted at a slowing pace of rate hikes.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Deve Gowda's son-in-law Manjunath to lock horns with Congress' DK Suresh

Apr 26, 2024 9:11 AM