Indian equity benchmarks fell on Thursday, resuming a downward after a day's breather, amid weak global cues, as nervousness persisted among investors ahead of a key US inflation reading due later in the day. Losses in financial, IT and FMCG shares weighed on Dalal Street though gains in healthcare stocks lent some support.

Investors awaited more of financial results from India Inc for domestic cues after TCS kicked off the earnings season on a strong note.

Both headline indices fell as much as one percent during the session. The Sensex lost 570.2 points to 57,055.8 at the weakest level of the day, and the Nifty50 dropped to as low as 16,957, down 166.7 points from its previous close but managed to close above the psychologically-important 17,000 mark.

A total of 36 stocks in the Nifty50 basket finished the day lower. Wipro, SBI, Adani Ports, Larsen & Toubro and ICICI Bank were the top laggards.

Larsen & Toubro, UPL, Asian Paints, HDFC Life and Bajaj Finance — falling around 1-2 percent each — were some of the other worst-hit blue-chip stocks.

ICICI Bank, the HDFC twins, SBI, Larsen & Toubro and Wipro were the biggest drags on both Sensex and Nifty50.

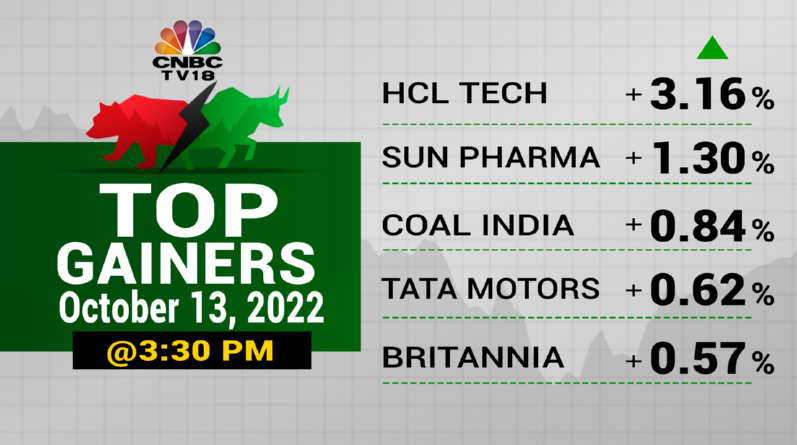

On the other hand, HCL Tech, Sun Pharma, Coal India, Tata Motors, Britannia,

Dr Reddy's, Grasim and Reliance — rising between 0.2 percent and 3.2 percent — were the top gainers.

Wipro shares hit a 52-week low during the session, a day after the IT major reported a set of quarterly numbers that fell short of Street estimates.

HCL Tech shares rose after the company posted a better-than-expected quarterly numbers, and lifted its constant currency revenue guidance to 13.5-14.5 percent from 12-14 percent.

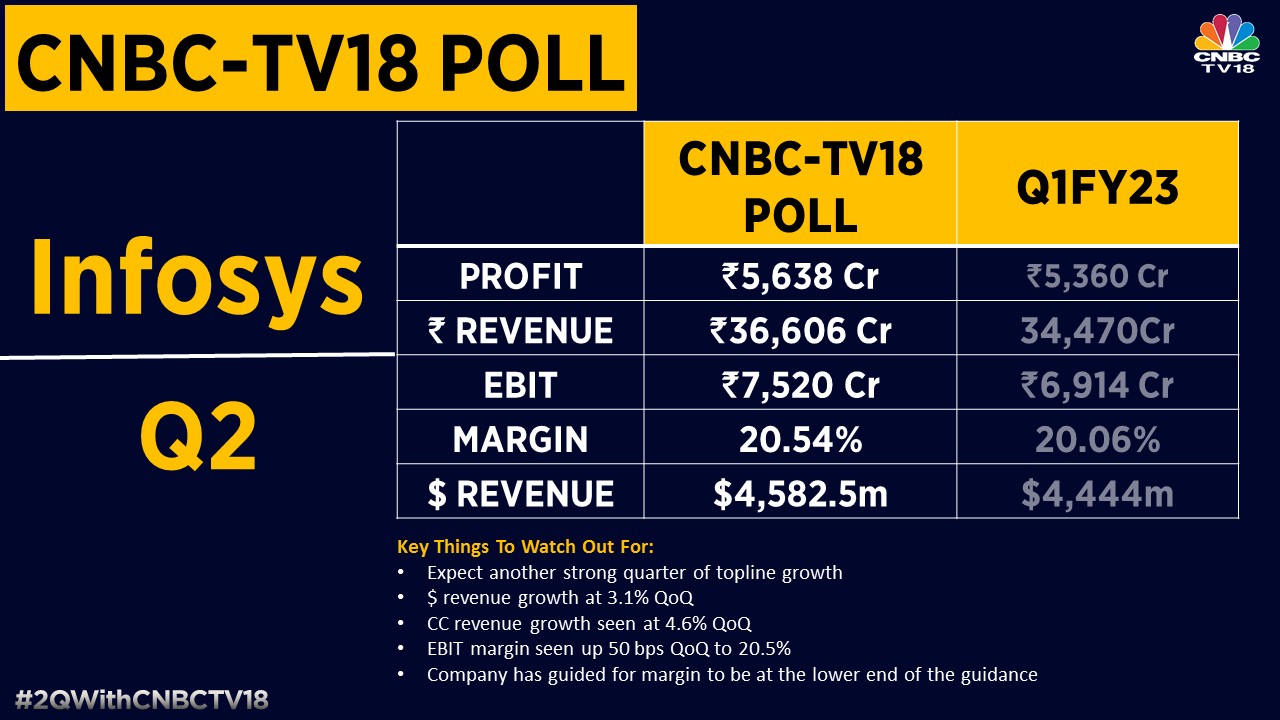

The Infosys stock closed half a percent lower, as investors awaited the IT giant's quarterly numbers due post-market hours.

Mindtree shares ended 0.8 percent lower ahead of the IT firm's results due later in the day. Analysts estimate the IT company's quarterly net profit at Rs 482.6 crore — which translates to a rise of 2.3 percent compared with the quarter ended June.

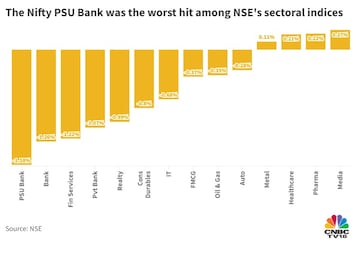

Most spaces succumbed to selling pressure, with the Nifty Bank — whose 12 constituents include SBI, HDFC Bank, ICICI Bank, Kotak Mahindra Bank and Axis Bank — being among the top laggards.

"Retail inflation persisting above desired levels has been a major cause of concern for the Indian economy. This along with declining industrial production may not be taken well by the market... The impending US inflation data, forecast to remain high, may cause volatility in the global markets," said Vinod Nair, Head of Research at Geojit Financial Services.

Overall market breadth turned in favour of the bears in the second half of the session from being neutral earlier in the day, with 1,293 stocks rising and 2,137 falling for the day on BSE.

The rupee inched lower to settle at 82.35 against the US dollar.

Global markets

European markets began the day in the red, mirroring a cautious mood across Asia, amid weakness in tech and realty shares. The pan-European Stoxx 600 fell as much as 0.7 percent in early hours, falling for the seventh day in a row.

S&P 500 futures were up 0.4 percent at the last count, suggesting a higher opening ahead on Wall Street.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM