Saurabh Mukherjea, Founder of Marcellus Investment, prefers to maintain investments in companies like Tata Consultancy Services (TCS), L&T Technology Services (LTTS), and Tata Elxsi, anticipating a turnaround in the Western economic cycle.

In a conversation with CNBC-TV18, Mukherjea, who manages funds worth over ₹10,000 crore ($1.2 billion), said there is an increasing demand for services related to artificial intelligence (AI) and cloud computing among Fortune 500 companies, and this transition to AI and cloud technologies will significantly benefit Indian IT firms.

“If the Western economic cycle turns in the next six months, it will be brilliant for our positions in TCS, but if it turns next year, so be it. We will have to stay patient and wait for the IT services cycle to turn. We think it will turn; it's a question of when, not if,” he noted.

Among other sectors, Mukherjea has investments in companies like RSI Magnesita, which supplies refractory materials to steel plants, and Shanthi Gears, a major player in the gears market.

Another company in Marcellus' portfolio is Grindwell Norton, a supplier of abrasives to auto manufacturers like Maruti, which the firm invested in a couple of years ago.

More recently, Marcellus positioned itself in Shanthi Gears, the second-largest gears company in India and part of the Murugappa Group. Mukherjea sees Shanthi Gears as a potential market leader, especially as it gains market share from its competitors within the Murugappa empire.

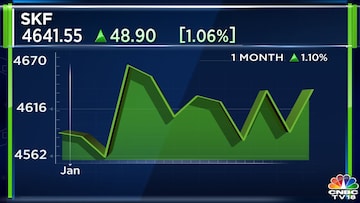

Marcellus has also invested in SKF, a multinational company and the largest player in industrial bearings. Mukherjea believes that as the industrial cycle picks up, SKF stands to benefit from increased demand for industrial bearings.

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

(Edited by : Shweta Mungre)