Shares of Samvardhana Motherson International Ltd (formerly Motherson Sumi Systems Ltd) tanked about 5.5 percent intraday as inflation more than halved June quarter net profit.

At 11:42 IST, shares of the company were trading 4.8 percent lower at Rs 122.45 on the BSE.

Here's how the company performed:

#1QWithCNBCTV18 | Samvardhana Motherson reports Q1 earnings.

▶️Net profit down 51.2% at ₹141.2 cr vs ₹289.6 cr (YoY)▶️Revenue up 8.9% at ₹17,454 cr vs ₹16,024 cr (YoY)▶️EBITDA down 16.1% at ₹829.1 cr vs ₹988.4 cr (YoY)▶️EBITDA margin at 4.7% vs 6.1% (YoY) pic.twitter.com/DiSuKhZRrJ— CNBC-TV18 (@CNBCTV18Live) August 8, 2022

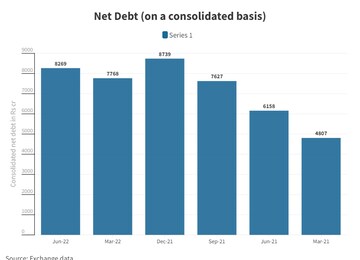

Despite the company reporting the highest ever quarterly revenues, Samvardhana Motherson’s net debt increased along with continued inflationary headwinds.

Consolidated net debt rose because of higher working capital requirements amid a challenging environment.

Also Read |

"Debt has risen slightly, but that is because we find it much more attractive to stock, and the global currency movement has been erratic. So, we increased our inventory holding last year, which is helping us more than troubling us,” Vivek Chaand Sehgal, Chairman, Motherson Sumi Group, told CNBC-TV18.

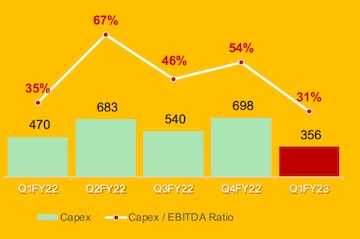

The company has a controlled capital expenditure plan to conserve cash.

According to Sehgal, within the next quarter or two, the company would start to see a decline in the working capital requirements and the capex. "The firm is trying to reduce capex as much as possible because it has already invested in all good new assets and the maintenance capex etc., is really very low," Sehgal said.

Firm's capital expenditure in Rs crore (Source: Exchange data)

Firm's capital expenditure in Rs crore (Source: Exchange data)Even as the company reported disappointing quarterly numbers, Sehgal said, “The market demand remains strong. However, OEM production volumes continued to fluctuate due to various supply chain constraints, including chip shortages. The passenger car sales have shown an improving trend from April to June."

Jefferies has an ‘underperform’ call on the company’s stock with a target price of Rs 105.

The automotive component manufacturing company is facing severe inflationary pressures, which has resulted in the brokerage firm cutting earnings per share estimates by 15-31 percent for FY23-24.

Jefferies pointed out that the stock is unlikely to perform until earning downgrades ease.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM