Hoping that the phase of 'everyday' decline in the market is over, Samir Arora, founder, Helios Capital, on Tuesday said that he expects the fall to stop for now.

"If the market is falling, the first thing you should hope and expect is that it will stop falling at that pace or whatever and then something else will happen or confidence will build or just time period will move," he said in an interview with CNBC-TV18.

Both the Senex and the Nifty have fallen over 6 percent this year so far due to a number of factors including the Ukraine-Russia war, the surge in COVID cases and the record inflation. While the Nifty has declined 12.8 percent from its all time peak hit in October last year, the Sensex has fallen 12.6 percent from that level.

Arora, however, said that a complete reversal in the market trend was likely only on an external event. According to him, V-shaped recoveries are not natural and have been always driven by central bank interventions.

"The only time these things vertically reverse is if a complete external event happens and those events are mostly related, at least in the last 10-20 years have been related to Federal Reserve putting in money or cutting rates, so that part is out," he said.

Going ahead, a mild recession in the US, likely in the next 12 months, will help India as it will lead to a correction in commodity and oil prices, as per Arora.

"India can handle a mild recession quite well," said Arora, adding that what the country cannot handle is a deep recession or any crisis in any part of the world.

Arora is 'underweight' on tech space but likes financials and some consumer stocks. Among financials, he has turned bullish on HDFC Bank.

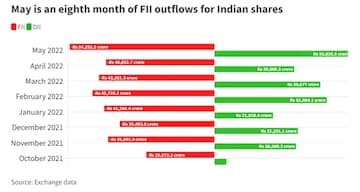

He expects foreign portfolio investors (FPIs), that have been net sellers for months in the recent past, to be net buyers next year.

In May, the net FPI outflow — the difference between the value of shares sold and that of shares bought — came in at Rs 54,292.5 crore, the highest for a month since March 2020 — when India first imposed the full lockdown to curb the spread of the pandemic.

“The selling that they have done this year doesn't look because of any specific India related reasons other than maybe market related reasons," said Arora.

Earlier in an interview with CNBC-TV18,

market veteran Madhu Kela, the founder of MK Ventures, had also said that a large part of the foreign institutional investors' selling seems to be over and some FIIs may look to buy, following a sharp correction seen in the currency market.

"If you see a one month back, the number (FII selloff) used to be Rs 5,000 crore, Rs 6,000 crore, Rs 7,000 crore a day. Now it has fallen more reasonably. Last maybe 15-20 days, the average (selling) would be Rs 1,500-2,000 crore," he had said.

First Published: Jul 12, 2022 12:46 PM IST