The board of

Route Mobile has announced a Rs 120 crore share buyback through the open market route at a maximum price of Rs 1,700 per share. This is a 28 percent premium from the previous close.

Despite the premium, the stock witnessed selling as investors were likely disappointed with the route of the share buyback. Shares of

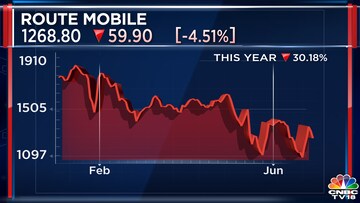

Route Mobile tanked as much as 7 percent on Wednesday.

At 12:54 IST, shares of the Mumbai-based cloud communications platform were trading 5.3 percent lower at Rs 1,258 on the BSE.

Also Read |

Share buyback via the open market means the company would buy shares from the market at the prevailing prices. A share buyback is a way for companies to halt the fall in the value of their stock by reducing supply in the market.

As per the company, the promoters would not participate in the share buyback exercise. The promoter and promoter group hold 59.82 percent stake in Route Mobile as of June 24, 2022.

Further, the buyback shall not exceed the maximum buyback size, which represents 9.95 percent and 7.31 percent of the aggregate of the total paid-up equity share capital and free reserves of the company, the company said in a press release.

The company has about Rs 1,026.2 crore of cash on the book as of March 31, 2022.

Earlier, the Indian cloud communications platform had indicated that it would look to do an acquisition in the voice and mobile identity services as digital frauds are going up.