Online trading platform Robinhood is planning to confidentially file for an initial public offering (IPO) in March. According to a Bloomberg report, the California-based Robinhood Markets has already held talks with underwriters, but a final decision has not been made. The timing of the listing could change, say people in know of the matter.

Robinhood, however, declined to make any comment officially when contacted by Bloomberg. This comes barely three weeks after the company faced a cash crunch when it ran into regulatory trouble.

Robinhood had to draw down its credit lines and raise $3.4 billion to post more collateral with the Depository Trust & Clearing Corporation (DTCC), the industry’s clearinghouse. Given wild swings in stocks, including those of video game retailer GameStop and movie theatre chain AMC Entertainment Holdings Inc, the DTCC wanted members to post more cash.

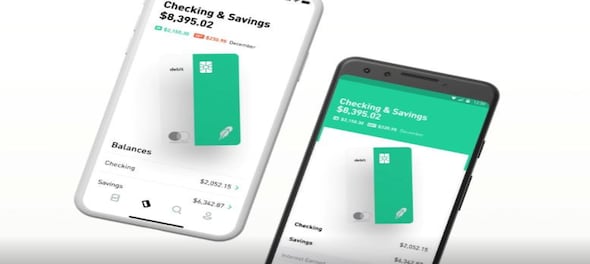

The trading platform, which has become popular during the pandemic with homebound youngsters turning to its trading app to make money and pass time, recently drew criticism after temporarily halting trading in GameStop and other companies’ shares, after retail investors caused a spike in the shares, shorted by hedge funds.

After this, it was hit by at least 33 federal lawsuits across the United States. Alleging violations of securities laws or consumer protection statutes, most of the lawsuits filed in 10 states, including California, Florida, Illinois, and New York, sought class action.

Valued at $11.7 billion in 2020, Robinhood, has been eyeing a stock market debut for a while now, according to a Bloomberg report.

The GameStop saga has brought Robinhood, with CEO Vladimir Tenev recently testifying before the US House Financial Services Committee.

Last year, Reuters had reported that Robinhood had picked Goldman Sachs Group to lead preparations for an initial public offering, which could value it at more than $20 billion.

(Edited by : Jomy)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM