In the last few months, there has been a complete decline in retail customers entering the equity markets and they are a drop in transactions as well. The number of retail clients with NSE is down by 38 lakhs in the last six months.

This means that many retail investors have stopped trading and the number of NSE clients is now actually the lowest in the last eight months.

Further, in the retail category, the HNI (high net worth individual) share in the cash market is down 44 percent. This number was a mind-boggling 66 percent of the total volume two years back.

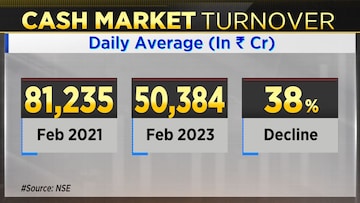

Cash Market Turnover

The daily average turnover, which had reached Rs 81,235 crore in February, has now reduced to Rs 50,384 crore, which is a drop of 38 percent. Market watchers say that this necessarily doesn't mean that people have lost interest in stock markets but rather that overall investments are down as inflation has hit.

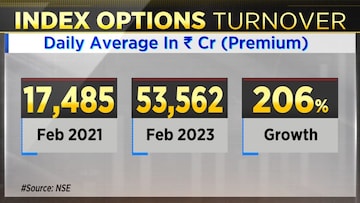

There is some interest in the market if we look at what's happening to the options turnover. This is the index option and we are only taking premium into account, not the overall notional turnover. The premium, which used to be Rs 17,485 crore in February, has gone up to Rs 53,562 crore, which is a 206 percent growth.

Market regulator, SEBI should be a bit worried, especially considering that 90 percent of F&O traders actually ended up losing money.

From October 2021 peak, the markets have been on a downhill. The Nifty is down 5 percent, the Nifty Midcap is down 8.2 percent and the Nifty Next 50, which is where a lot of portfolios are benchmarked to, it's actually down 16 percent. Equities are not giving you a return, the other thing is happening.

Also, in 2021, the fixed-income market was low, and the repo rate was 4 percent. Now the repo rate has gone up to 6.5 percent and it is expected to keep rising. Moreover, fixed income is it's generating a risk-free return of 7 to 8 percent.

(Edited by : Abhishek Jha)

First Published: Feb 25, 2023 3:45 PM IST