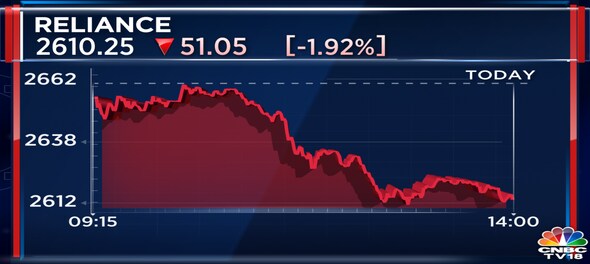

Shares of Reliance Industries Ltd (RIL) fell about 2 percent on Friday after the government once again revised the windfall tax levied on crude oil, diesel and Aviation Turbine Fuel. The cess on domestically produced crude oil has been slashed to Rs 13,000 per tonne from Rs 17,750 per tonne.

“The cess has been reduced to ~US$22/bbl from August 19 in the third review of windfall taxes. This will reduce cess on domestic oil production companies,” said ICICIDirect Research.

At 12:24 am, RIL stock was trading 1.5 percent lower at Rs 2,621.9 on the BSE.

Also Read |

Further, the conglomerate’s scrip traded ex-dividend on Thursday, a day ahead of its record date, which would determine eligible shareholders for the payout.

The oil-to-telecom major will pay a dividend of Rs 8 per equity share for the financial year ending on March 2022.

Besides, RIL will be holding its 45th Annual General Meeting (AGM) on August 29, 2022.

Also Read | Bottomline: Of windfall cess, and the oil mess

According to JM Financial Institutional Securities, the key expectations from the AGM are around any updates on:

(1) timeline for potential listing of its three key businesses – Jio, Digital and oil to chemicals

(2) potential strategic stake sale in oil to chemicals, retail and new energy business

(3) likely 5G roll-out and monetisation plans.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM