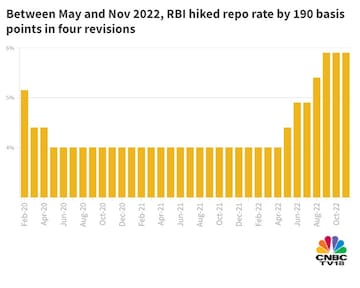

The RBI's rate-setting panel — the Governor Shaktikanta Das-headed Money Policy Committee — has raised the benchmark interest rate by a total of 190 bps so far in 2022, in tandem with major central banks' battle against surging consumer prices. Central bankers in major economies around the globe — be it in India or the US — have a difficult task at hand: Balancing inflation, or the pace of increase in the price the consumer pays for a commodity, with just enough supply of money so that it doesn't hamper the economy two and a half years into the pandemic.

Many economists see room for more increases in the repo rate — the key interest rate at which the RBI lends money to commercial banks — as the overall pace of consumer prices continues to be beyond the RBI's comfort zone.

Morgan Stanley Chief Asia Economist Chetan Ahya told CNBC-TV18 he expects the RBI to make a small rate cut by the end of 2023. He believes that 90 percent of Asian economies will have inflation within their central banks' comfort zone by mid-2023.

India’s capex cycle has begun and economy should grow by 6.2% next year & 6.5% in FY25, says @MorganStanley’s Chetan Ahya. He tells @latha_venkatesh that he expects a small rate cut from RBI by end-2023 1/2 pic.twitter.com/nCJb1QpAy5

— CNBC-TV18 (@CNBCTV18News) November 17, 2022

Morgan Stanley expects GDP growth in Asia to improve 4.6 percent in the second half of 2023, from 3.5 percent currently, he said.

So what has changed since the MPC's last policy review?

In its last policy statement, dated September 30, the RBI's MPC decided to hike the repo rate by 50 bps — a third straight revision of 50 bps and a fourth overall in the current tightening cycle.

However, the panel's resolution was not unanimous — a first in the post-pandemic era. While Governor Shaktikanta Das and four other MPC members voted to raise the repo rate by 50 bps, one member, Ashima Goyal, voted to lift it by 35 bps.

It is this dissent that many economists read as an early sign of at least some moderation, if not an end, to the current pace of hikes.

The MPC maintained its retail inflation forecast for the year ending March 2023 but lowered its GDP projection by 20 basis points.

Some see easing crude oil prices as a relief to the overall CPI but suggest a 'wait and watch' approach before taking a call on an end to the current cycle of rate hikes.

Benchmark oil prices have declined sharply in the past few days amid fears that fresh lockdowns in China thanks to resurgent COVID infections will hamper global demand. Falling oil prices are positive for countries such as India, which meets the lion's share of its oil requirement through imports.

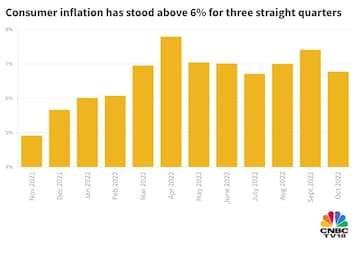

The MPC met again in November to discuss a report it would submit to the government explaining why inflation had stayed out of control. This meeting was not to discuss policy action as it is mandated by law, created in 2016, for the RBI to come up with a report in case it fails to tame inflation for three back-to-back quarters.

What to expect from RBI from now on?

Madan Sabnavis, Chief Economist at Bank of Baroda, believes there is scope to increase the repo rate by another 50-60 bps by March.

"We can look at 6.5 percent as the terminal repo rate by March. It will be two increases of 25-35 bps (each). There is no need for an aggressive 50 bps as inflation has started to slow down," he told CNBCTV18.com.

The consumer inflation-targeting MPC aims to keep inflation within 2-4 percent — something it has failed to achieve since late last year.

"As inflation has moved down for October and will continue to do so in the next few months, though it may remain above 6 percent, there is scope for slower rate hikes now," Sabnavis said.

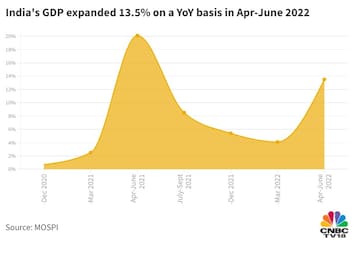

Many experts are banking on the resilience of the Indian economy compared with major economies around the globe.

Global economic activity is undergoing a sharper-than-expected slowdown, with higher inflation in developed countries than their emerging market counterparts, SBI Chairman Dinesh Kumar Khara pointed out in an interaction with CNBC-TV18 this month.

"Financial conditions in most of the regions have got tightened. Russia’s invasion of Ukraine and the lingering COVID-19 pandemic weigh heavily on the outlook. However, in such an uncertain and fragile global economic environment, the Indian economy has shown its resilience all these years," he said.

"Indicators of aggregate demand indicate that the onset of the festive season and the pent-up demand kept the growth impulse very strong," Khara added.

Economists will look for an official reading on India's gross domestic product (GDP) in the July-September period, due at the end of November.

First Published: Nov 22, 2022 4:09 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM