After a robust July for PVR Inox, August is seeing strong advance numbers from ‘Gadar 2’ and impressive numbers from ‘Jailer’ starring Rajinikanth as well. With content making a strong comeback, strong footfalls were seen for extended days given August 15 was a holiday, and a pent-up demand for the sequel of ‘Gadar’ and Rajinikanth’s ‘Jailer’.

PVR Inox's performance update states that they have achieved the ‘highest ever daily and weekend admissions and box office’. According to foreign brokerage CLSA, PVR Inox, on August 13, achieved its highest-ever admissions and gross box-office collection in a single day.

"On August 13, PVR Inox had 12.8 lakh admits and 33.6 lakh admits over Friday to Sunday with GBO revenue over Rs 100 crore. We think this implies an occupancy of 72-75 percent on Sunday and 63-65 percent over three days," said domestic brokerage ICICI Securities in its report.

Gadar-2 lived up to its name and created havoc at the box office. The film’s domestic gross collection stands at Rs 308.5 crore.

Superstar Rajinikanth-starrer Jailer, another highly anticipated movie, has also stormed the box office with collections of Rs 470 crore worldwide.

After a slow start, Oh My God-2 has picked up pace and has netted Rs 111.8 crore worldwide.

Bhola Shankar, starring Chiranjeevi, experienced a mixed response at the box office, accumulating a total collection of Rs 28.95 crore in its initial seven days.

"Further, with movies like Dream Girl-2, Jawan and Salaar due for release in the second quarter of FY24, we expect sharp improvement in box office performance this quarter," according to Jinesh Joshi – Research Analyst at Prabhudas Lilladher.

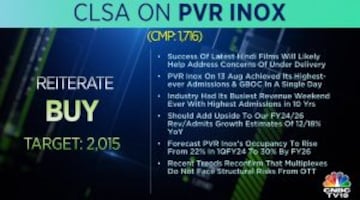

According to CLSA, the success of the latest Hindi films will likely help address concerns of under-delivery. It forecasts PVR Inox's occupancy to rise from 22 percent in Q1 of FY24 to 30 percent by FY26. The recent trends reconfirm that cinemas do not face structural risks from OTT, the brokerage said, assigning a 'Buy' rating to the counter, with a target of Rs 2,015 per share.

Analysts believe that investor concerns around digital disruption by OTT (over-the-top) players were one of the key reasons behind PVR Inox's de-rating. "Now, as a strong content pipeline manifests into tangible box office collections, we think investor concerns regarding the relevance of movie exhibition in today’s context should be assuaged," ICICI Securities said.

Robust revenue likely in Q2

Analysts have been bullish on the recovery of the movie exhibition business given the strong pipeline since the July-September quarter of FY24. However, they believe the current performance is a positive surprise.

"Merger synergies have also started playing out. Given the high operating leverage that plays out in this business, we believe earnings upgrades are necessary. We, therefore, upgrade adjusted EBITDA estimates for FY24E/25E by 48 percent/12 percent," ICICI Securities stated.

The brokerage is now 52 percent/8 percent above its consensus. Given its bull case is playing out, PVR Inox remains its top pick as the brokerage has a 'Buy' rating, with a revised target price of Rs 2,240.

Shares of PVR INOX Ltd were trading 0.22 percent higher at Rs 1,720 apiece in trade today. The stock has risen 5.09 percent in the last five trading sessions, while it's up 22.64 percent in the last one month.

First Published: Aug 18, 2023 1:38 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM