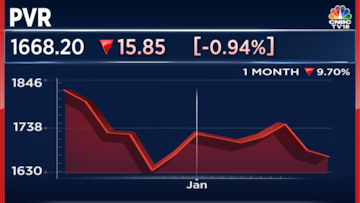

PVR has seen a sharp correction after news of its merger with INOX Leisure broke. The stock is down almost 10 percent in the past month but is flat when seen over a three-month period. Nirmal Bang CEO Rahul Arora reckons it's a stock to add to one's portfolio.

In an interview with CNBC-TV18, he said that VR is a dominant player in its field and believes that if multiplex stocks fall by 15 percent, they would become good picks for portfolio investors.

"Currently, with advertising margins at 95 percent gross, food and beverage (F&B) margins are almost at 75-80 percent gross. If the box office picks up, which is 55-60 percent gross margin business, it will flow through to the bottomline, he said.

According to an ICICI Direct Research’s report, Q3FY23 was a decent quarter with a box office recovery aided by movies such as Avatar 2, Drishyam 2 and Kantara. It expects multiplexes to grow nearly 35-40 percent sequentially in terms of box office revenue, while footfalls may rise between 22-30 percent.

Moreover, the average ticket prices for PVR and Inox may rise 7 percent quarter-on-quarter.

“Structurally it is a beautiful business and if you get it a little cheaper, 15-20 percent from here (current price at Rs 1662) then it’s a core portfolio hold for me, one of the best discretionary names,” said Arora.

Arora also highlighted some sectors that he believes will perform well in the current market conditions. He said that he likes infrastructure and cement stocks, as companies in these sectors will likely benefit from the current economic climate.

Arora also touched on the retail sector, noting that valuations for Avenue Supermarts are similar to HDFC Bank. However, he pointed out that the growth rate for Avenue Supermarts would need to be very high in order to justify such premium valuations. He said that the market is expecting the company to deliver compounding growth of 25-30 percent.

In the current market conditions, Arora noted that liquidity is withdrawing, which could make it difficult for new-age companies to perform well. However, he said that these companies will likely get the benefit of the doubt from the market if their cash burn declines. Overall, Arora's comments provide valuable insights into the current state of the stock market and which sectors and companies may be worth considering for investment opportunities.

For more details, watch the accompanying video