Shares of public sector banks (PSBs) have outperformed private sector banks (PVBs) in the past three years but it may be time to re-think, says global brokerage Bernstein. The analyst believes it’s time to switch back to private banks. Why?

Because, looking ahead, Bernstein sees a less promising trajectory for public sector banks as they struggle with weaker deposit growth (despite aggressive pricing) and much lower liquidity buffers (than what a lower loan-to-deposit ratio might suggest). That, in turn, results in weaker earnings growth versus private banks, it said in its latest report on March 10.

But is it all bad? The brokerage has downgraded State Bank of India (SBI) to market perform call but raised the target price to ₹780. This is because it sees better growth prospects for the largest public sector lender from a new-found willingness to raise capital fully priced in.

| Nifty Bank 3-year return | 35.79% | ||

| Public sector bank | 3-yr stock price return | Private sector bank | 3-yr stock price return |

| Bank of Baroda Ltd | 255.13% | Kotak Mahindra Bank Ltd | -11.89% |

| Bank of India | 93.63% | Federal Bank Ltd | 78.99% |

| Bank of Maharashtra | 175.43% | HDFC Bank Ltd | -7.91% |

| Central Bank of India | 241.44% | ICICI Bank Ltd | 73% |

| Canara Bank | 272.36% | IndusInd Bank Ltd | 48.35% |

| Indian Bank | 309.46% | Axis Bank Ltd | 46.81% |

| Indian Overseas Bank | 274.49% | RBL Bank Ltd | 4.80% |

| Punjab & Sind Bank | 263.97% | City Union Bank Ltd | -21.98% |

| Punjab National Bank | 218.07% | IDFC First Bank Ltd | 20.94% |

| SBI | 103.46% | Bandhan Bank Ltd | -45.27% |

| UCO Bank | 327.31% | ||

| Union Bank of India | 322.19% | ||

Bernstein is not the only one that holds this view.

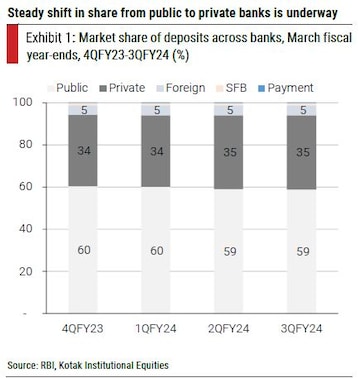

On March 4, Kotak Institutional Equities pointed out that the deposit share of public banks is at 60% and private banks at 35%.

“Public banks have lost 200 basis points (bps) in market share largely to private banks since 4QFY23. This loss is visible in metropolitan regions after 2Q, which could be driven by the merger of HDFC group,” the Kotak report claimed.

The domestic brokerage, however, explained that it is awaiting a firm turnaround in deposit mobilisation. “We do see competition being fairly strong, with public banks likely to erode their market share slower than what was seen earlier, putting pressure on deposit shifts across players.”

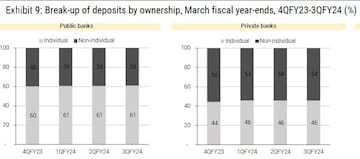

Another trend seen in deposits is that individual deposits are higher for public banks and non-individual shares are higher for private banks, as per the report. And individual deposits are largely with public banks and the shift is a lot more gradual in nature.

Meanwhile, households dominate deposits at 60% and of these households, 30% of savings and 50% of term deposits come from senior citizens.

Reflecting on term deposits, the Kotak report said, the recent RBI update on quarterly deposits indicates that public banks have a 60% share in deposits but have lost 200 bps since 4Q largely to private banks.

Private banks have a marginally higher concentration of deposits in metropolitan markets compared to public banks. Also, deposit mobilisation by banks continued to remain skewed in the 1-3-year bucket and it continues to rise consistently. "There is a 10% point jump in the 7-8% interest rate bucket, suggesting we are moving closer to headline deposit rates. We should see deposit rates closer to peak levels,” it said.

But, is all well with private banks then?

As per its latest brokerage note, CLSA has downgraded HDFC Bank to outperform from buy and cut the target price to ₹1,650 from ₹2,050.

According to the brokerage, there are twin challenges on deposits — a high ask rate and a tough environment.

It said that improving yields offset by muted current account and savings account (CASA) accretion to keep net interest margin (NIM) recovery gradual. The brokerage believes NIM recovery will be more ‘U-shaped’ than ‘V-shaped’. It has trimmed FY25/26 earnings per share (EPS) estimates for HDFC Bank by 5%.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM