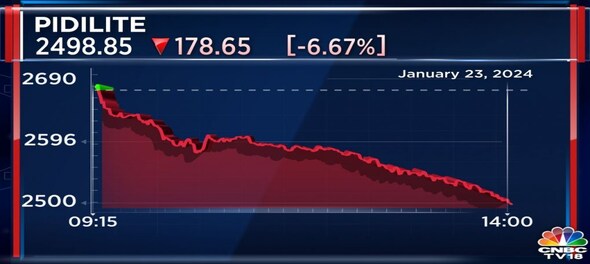

Pidilite Industries share price tumbled more than 6.5% in trade on Tuesday, January 23, ahead of Fevicol-maker's third-quarter results later in the day. Pidilite Industries stock price opened at ₹2,674.90 and hit the day's low price of ₹2,488.10.

Pidilite Industries Q3FY24 results preview

Pidilite Industries' revenue is expected to come in at ₹3,206 crore, while net profit is expected to come in at ₹495 crore, as per a CNBC-TV18 poll estimate.

Pidilite is expected to report an expansion in gross margin at approximately 800-1000 basis points year-on-year. The street also expects EBITDA margins to stay in the company's guided 20–24% band.

#CNBCTV18Market | Pidilite's #Q3 results are expected to report an expansion in gross margin at approx 800-1000 bps YoY. The street also expects EBITDA margins to stay in co’s guided 20-24% band pic.twitter.com/W3uPWxkYAZ

— CNBC-TV18 (@CNBCTV18Live) January 23, 2024

Pidilite reported a 35.7% year-on-year (YoY) jump in net profit at ₹458.5 crore for the second quarter that ended September 30, 2023. The CNBC-TV18 poll had predicted a profit of ₹456 crore for the quarter under review. Pidilite Industries posted a net profit of ₹337.8 crore in the corresponding quarter last year.

The company's revenue from operations increased by 2.2% to ₹3,076 crore against ₹3,011.2 crore in the year-ago period, falling short of the CNBC-TV18 poll prediction of ₹3,162 crore for the quarter under review.

In early November, the company announced its foray into the lending arena, surprising the Street. The move is aimed at providing small-value retail loans to support its ecosystem and included the acquisition of the promoter-owned NBFC, Pargro Investments, for a fair asset value of ₹10 crore, with an anticipated investment of ₹100 crore over the next two years through debt and equity.

First Published: Jan 23, 2024 2:16 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM