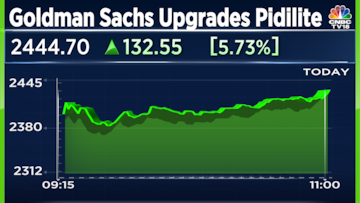

Shares of adhesives manufacturer Pidilite Industries Ltd. gained over 5% on Tuesday after getting an upgrade from Goldman Sachs. The stock is also the top gainer on the Nifty Next 50 index.

Brokerage firm Goldman Sachs upgraded the stock to "buy" from its earlier rating of "sell" and also raised its price target higher to ₹2,725 from ₹2,350 apiece. The revised price target implies a potential upside of 18% from Monday's close.

Goldman Sachs believes that the earnings downgrade cycle is behind for Pidilite Industries, which is India’s largest manufacturer of adhesives, as new growth drivers are emerging.

The brokerage has increased Pidilite's earnings estimates for financial year 2025 and 2026 by 4% and 8% respectively, while accounting for higher revenue from new growth products and improved operating profit margins on lower input costs.

It also expects a strong recovery in the company's operating profit margin or EBITDA margin, which is likely to rise to 23.1% in financial year 2026 from 16.7% in financial year 2023.

Among the key risks to its recommendation, Goldman Sachs has highlighted a slowdown in home construction or a sharp rise in input costs, which may adversely impact the company's margin.

Pidilite is also set to announce its earnings for the September quarter on November 8.

For the June quarter, the company had reported revenue growth of 6% from last year, while EBITDA margin had expanded by 400 basis points.

Shares of Pidilite are trading 5.8% higher at ₹2,445.9. The stock is still down 4% so far in 2023.

(Edited by : Hormaz Fatakia)