The shares of One 97 Communications (Paytm) gained 5% to hit the upper circuit for the second straight session on Monday, February 19. This development came after the crisis-ridden company partnered with Axis Bank for the settlement of merchant payments.

One97 Communications has shifted its nodal account to Axis Bank through an escrow account that it has opened with it.

Additionally, the stock received a boost following the Reserve Bank of India's (RBI) FAQs, providing clarification on the continuation of Paytm QR, Card machine, and Soundbox services beyond March 15.

At the opening bell, Paytm's stock reached its upper price band of 5% at ₹358.55 on BSE.

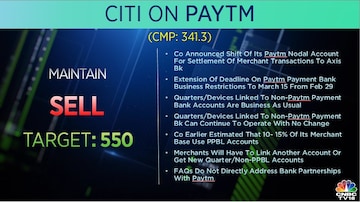

While brokerage firm Bernstein recommended an outperform rating on the stock with a target of ₹550, Citi maintained a sell call on the stock despite suggesting a target of ₹550.

Citi acknowledged the positive impact of new partnerships on Paytm's business and anticipated more bank collaborations.

According to Bernstein, the RBI's regulatory actions primarily targeted Paytm Payments Bank (PPBL), with no intention to disrupt other essential functions of Paytm.

Paytm clarified in a BSE filing that the partnership with Axis Bank aimed to replace the nodal account previously used with Paytm Payments Bank.

Paytm Payment Services, a wholly owned subsidiary, has been utilising Axis Bank services since its inception.

Paytm Payments Bank has received an extension on various directives from the RBI.

After March 15, 2024, customers will no longer be able to make deposits or top-ups into their accounts, prepaid instruments, wallets, FASTags, or National Common Mobility Cards (NCMC).

This extension goes beyond the initially set deadline of February 29.

Exceptions to this rule include interest, cashbacks, sweep-ins from partner banks, or refunds, which may be credited at any time.

Customers retain the freedom to withdraw or utilise their balances without restrictions, as previously communicated.

Paytm Payments Bank will cease all banking services after March 15, except for withdrawals and balance utilisation.

The bank is prohibited from offering other banking services, such as fund transfers (including AEPS, IMPS, and UPI), Bharat Bill Payment Operating Unit (BBPOU), and the Unified Payments Interface (UPI) facility.

The Nodal Accounts of One97 Communications and Paytm Payments Services, maintained by PPBL, are to be terminated by February 29, consistent with previous instructions.

Paytm Payments Bank will facilitate the seamless withdrawal of customer deposits parked with partner banks under the automatic 'sweep-in sweep-out' facility, as stated by the RBI.

(Edited by : Amrita)

First Published: Feb 19, 2024 10:07 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM