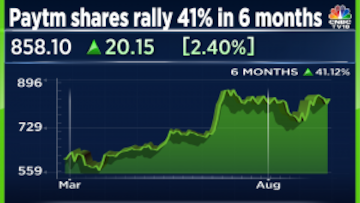

Shares of One97 Communications, the operator of payments and financial services company Paytm, rallied more than 3 percent in Tuesday's trade after the fintech giant said it is investing in artificial intelligence (AI), focusing on building an Artificial General Intelligence software stack. At 12:04 pm, the scrip was trading 2.45 percent higher at Rs 858.45 apiece on the NSE.

Paytm shares opened at Rs 844.55 level and went on to hit an intra-day high of Rs 861.95 apiece on the NSE. The stock has climbed 61.34 percent on a year-to-date basis, while it has risen 10.59 percent in the last one year. Shares of Paytm have bounced back 96 percent from its 52-week low level of Rs 439.6, hit on November 24, 2022.

According to data from Trendlyne, Paytm has a target price of Rs 1,036, implying an upside potential of 21 percent from the current market prices. The consensus recommendation from 13 analysts for the counter is a 'Buy'.

'Paytm investing to build AI software stack'

In its annual report for 2022-23, Paytm chief Vijay Shekhar Sharma said that the fintech firm is building India scale AI system to help financial institutes capture risks and frauds. This development is not intended solely for the Indian market but can also be leveraged outside India.

"I am very proud of our Advanced AI capabilities in use and how we are expanding. We are building an India scale AI system which will help various financial institutes in capturing possible risks and frauds, while also protecting them from new kinds of risks due to advancement in AI. Paytm is investing in AI with an eye on building Artificial General Intelligence software stack. We believe by building it in India we are not only making our country’s tech capability, also creating something that could be leveraged outside India," Sharma noted.

The initial application that Paytm aims to harness AI for is small mobile-led credit. Explaining further, he said: "In India’s digital revolution, following mobile payments, Paytm’s next significant contribution will be small mobile credit with high credit quality and full compliance with regulators' guidelines. This endeavour demands sophisticated capabilities in AI and other technologies. I am immensely proud of our advanced AI capabilities in use and our ongoing expansion."

In his letter to shareholders, Sharma also said that Paytm pioneered mobile payments in India and led mass adoption with innovations such as QR Codes and Soundbox.

Beyond payment and credit disbursement business, the Paytm boss said he is excited by possibilities of Open Network of Digital Commerce (ONDC).

''We have seen very encouraging early results of the same. In my opinion, in the next three years you will see some worthy numbers and results of hard work put in by the team. Your company's team remains committed to serve India and build a long term profitable business,'' Sharma stated.

Paytm had earlier mentioned that it is gunning for cash flow positive as its next milestone. “In my opinion, in the next three years you will see some worthy numbers and results of hard work put in by the team. Our team remains committed to serve India and build a long term profitable business,” he added.

In the June quarter, Paytm's losses were reduced to Rs 358.4 crore, down from a loss of Rs 645.4 crore in the same period the previous year. Revenue from operations for the payments major stood at Rs 2,341.6 crore for the June quarter, a 39.4 percent increase year-on-year.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM