Shares of Paytm are locked in another lower circuit of 20% on Friday after a 20% drop on Thursday. The stock is now at ₹487, nearing on its all-time low of ₹438, which it fell to in March 2022.

Paytm founder Vijay Shekhar Sharma held an analyst call on Thursday post the Reserve Bank of India's actions on Paytm Payments Bank during which he called the move a "speed bump," and added that with partnerships with other banks, the company will "see this through the next few days or quarters."

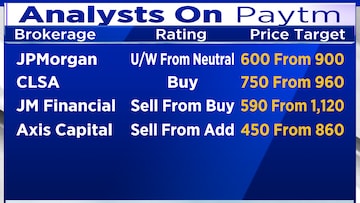

After Jefferies became the first brokerage to downgrade Paytm post the recent developments, more downgrades have come from analysts.

JPMorgan has downgraded the stock to Underweight amidst risks to profit pool and competitive advantage and mounting adverse regulatory risks. The brokerage has also cut its price target on the stock to ₹600 from ₹900 earlier.

"The order materially impacts Paytm's core payments business impacting payment revenue growth and net payment margins," JPMorgan wrote in its note.

CLSA has also cut its price target on Paytm to ₹750 from ₹960 earlier, although it has maintained its buy recommendation on the stock. However, the brokerage mentioned that there could be near-term volatility in the stock price.

It has cut Paytm's EBITDA ex-ESOPs estimates by 18% and 22% for financial year 2026 and 2027 and also its GMV growth estimates by 8%.

Downgrades for Paytm have also from from JM Financial and Axis Capital. In fact, Axis Capital now has the lowest target on the street for Paytm at ₹450, which is close to its all-time low. It has downgraded its rating from "add" to "sell".

JM Financial has also cut its target on Paytm to ₹590 from ₹1,120 earlier and downgraded its rating to "sell" from "buy."

Out of the 15 analysts that have coverage on Paytm, four of them now have a "sell" rating, while seven continue to maintain a "buy" recommendation.

Shares of Paytm are now 75% away from their IPO price of ₹2,150.

First Published: Feb 2, 2024 9:15 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM