Brokerage firms on Friday (March 15) envisioned a significant transformation in Paytm's operational strategy, likening it to the business models of competitors like PhonePe and Google Pay. This development came after the National Payments Corporation of India (NPCI), on Thursday (March 14), granted Paytm's parent One97 Communications Limited a third-party application provider (TPAP) license under the multi-bank model.

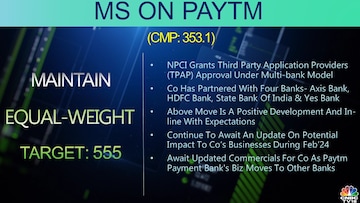

Brokerage firm Morgan Stanley offered a nuanced perspective on the regulatory developments surrounding Paytm.

Maintaining an equal-weight call with a target price of ₹555 per share, the brokerage highlighted the positive impact of the regulatory clearance.

However, it emphasised the need for further updates on the potential implications for Paytm's businesses during February 2024.

UBS, on the other hand, stressed the transformative nature of the regulatory shift and highlighted the removal of transactional linkages between Paytm and its payments bank.

This transition paves the way for Paytm to operate in a manner similar to its competitors, such as Google Pay and PhonePe, reshaping its business model and strategic focus, it said.

UBS further anticipated challenges ahead, projecting a potential churn in customer and merchant bases and a subsequent decline in market share amidst regulatory headwinds.

Speaking on specifics of Paytm's market performance, the brokerage firm noted a significant decline in its share within the overall Unified Payments Interface (UPI) market by 1.8 percentage points in February.

Anticipating future trends, UBS projected a reduction in Paytm's share in digital payments, forecasting a decline to 17% in FY25E from the previous 25%, primarily driven by the loss of wallet business, accounting for a permanent loss of 2 percentage points, and additional attrition due to merchant and customer churn.

On expectations regarding Paytm's loan origination, UBS indicated a temporary pause for most of the fourth quarter followed by a resurgence post-stabilisation of its payments business in FY25E.

The brokerage forecasted a 5% year-on-year decline in loan disbursements for FY25E, alongside an anticipated 2% decline in overall revenues for the same financial year.

Jefferies, meanwhile, said that the regulatory approval is a crucial milestone for Paytm.

The brokerage firm emphasised the removal of the last remaining regulatory challenge, ensuring a smoother transition for customers and merchants.

It noted current trends indicating that the quantum of impact may be restricted to less than 20% compared to January 2024 levels.

Furthermore, Jefferies highlighted the transformation of Paytm's business model, likening it to pure payment service providers such as PhonePe and Google Pay.

This evolution is expected to prompt Paytm to pursue a deeper engagement with banks and regulated entities, signalling a strategic pivot in its operational approach.

Moreover, Jefferies anticipated that Paytm would utilise a substantial portion of its cash reserves, exceeding $1 billion, for merchant and customer retention initiatives.

However, the firm acknowledged both positive and negative risks stemming from factors such as user and merchant retention, revenue traction, and cost controls.

On Thursday (March 14), shares of One 97 Communications settled 0.38% higher at ₹353.25 on BSE.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM