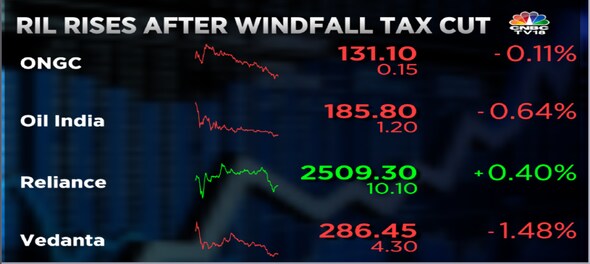

Share of Reliance Industries Ltd rose while those of Oil & Natural Gas Corp (ONGC) declined amid mixed moves across the oil & gas pack on Monday, after the government lowered a windfall tax on domestically-produced crude oil and the export of diesel and jet fuel. The Reliance stock was up 0.5 percent, but ONGC was down 0.4 percent and Oil India down one percent in early afternoon deals on BSE. Vedanta shares were down 1.7 percent.

The windfall levy on domestic crude oil impacts companies such as ONGC and Vedanta, and that on diesel and jet fuel exports impacts Reliance, a principal exporter of the fuels.

The Centre brought down the tax on hefty profits arising out of domestically-produced crude oil — thanks to a surge in global prices earlier this year — by Rs 2,800 to Rs 10,500 per tonne, in line with international rates.

It also reduced a levy on the export of diesel and aviation turbine fuel under a fortnightly review, by Rs 3.5 to Rs 10 per litre and by Rs 4 to Rs 5 a litre respectively.

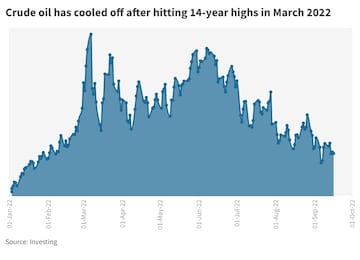

A drop in crude oil rates to the lowest in six months led to the reduction in the windfall tax. As of Monday, benchmark Brent futures have eased almost 34 percent from a 14-year peak of $139 a barrel touched in March this year.

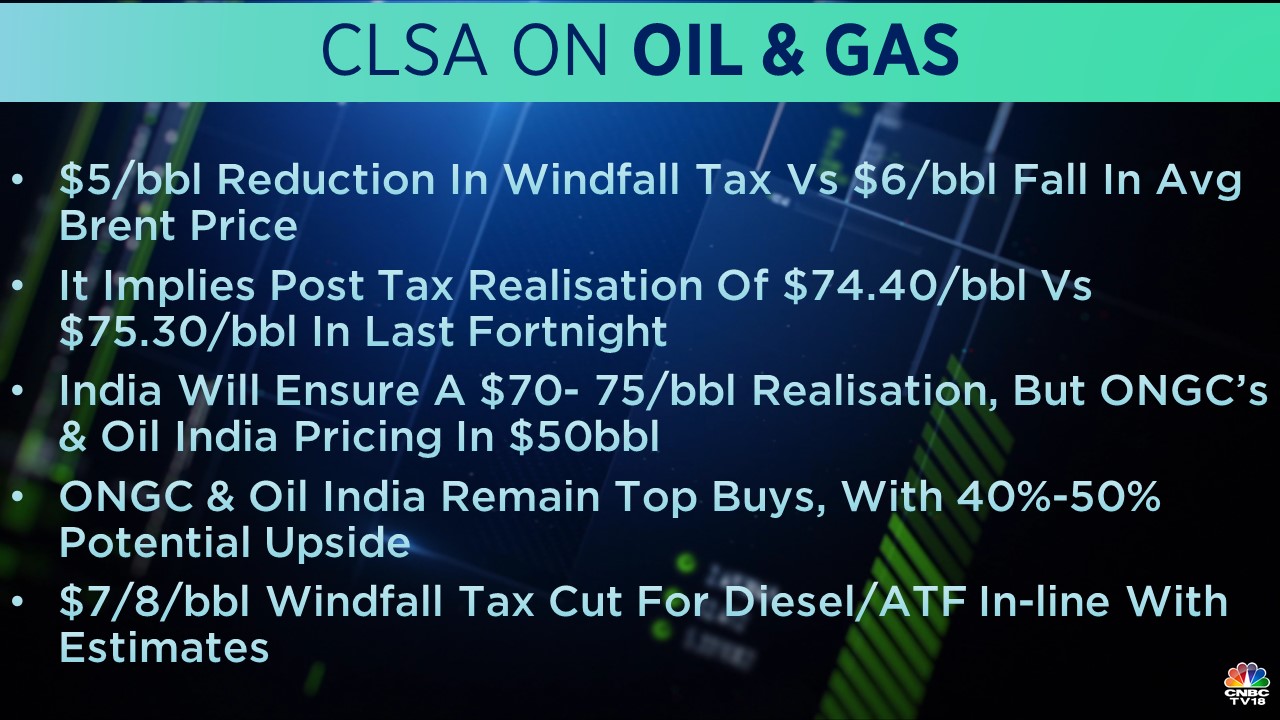

CLSA sees up to 50 percent upside in ONGC and Oil India shares — as both remain its top picks. The latest windfall tax moves by the government are along expected lines, according to the brokerage.

Many analysts on Dalal Street suggest avoiding the pack due to high volatility.

"Oil & gas stocks have created lots of noise in the past years but no real wealth as such... Even those holding ONGC shares can just exit on any chance they get," AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com earlier this month.

India first imposed the windfall tax on July 1, joining a number of nations that tax energy firms' above normal profits arising out of a sudden jump in oil rates. However, global crude oil rates have cooled off since then, eroding the profit margins of both oil producers and refiners.

In a separate development, ONGC has urged the government to scrap the windfall tax on crude oil and use the dividend route instead to tap into the bumper earnings of explorers.

Indian equity benchmarks Sensex and Nifty50 recovered initial losses in a volatile session on Monday, but nervousness persisted among investors globally ahead of key central bank decisions due this week amid recession warnings from the IMF and the World Bank.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 60% voter turnout recorded by 5 pm

Apr 26, 2024 9:11 AM